Ben Muse |

|

|

Economics and Alaska To leave a comment click on the word "comment" at the end of each post. Click here for Atom feed Juneau webcams

Alaska/Yukon photos

Race for World Bank PresidentThe Fight for Free Trade

Economics blogs

Australian economics bloggingCanadian economics bloggingUK economics bloggingViennese economics bloggingSports economics blogsTax blogsOther blogs

Economic Columnists

Journals OnlinePolicy Essays and Papers

Archives

Where are visitors to this page? (Auto-update daily since 12-27-04) |

7/31/2003

Pentagon terror futures market The Pentagon's experiments with a futures market to organize information on future terror acts wasn't as hair-brained as sometimes portrayed. Arnold Kling links to several bolg postings or newspaper columns that are relatively favorable, here: "Terrorism Futures". A link to a Hal Varian column in the New York Times may not last long, but here is a link to the same column on Varian's home page: "A Good Idea With Bad Press". Mark A.R. Kleiman is disappointed in the politicians who demogauged this idea to death, and points to the chilling effect this will have an innovation in the office that developed the idea:

7/30/2003

Custer's Last Stand story What happened to the 7th Cavalry trooper who carried Custer's request for reinforcements as the Little Big Horn battle began on June 25, 1876? He served in the Spanish American War, worked on the New York City subway, and died in 1922 after being hit by a beer truck. The New York Times has the story, here: "Custer's Bugler, Playing the Subway?" Thanks to Cronaca for the link. The terrorist supply curve ParaPundit points to a Washington Post story with evidence that the opportunity cost for engaging in terror attacks on U.S. troops is increasing, shifting the supply curve up and to the left, increasing price (from $300 per murder a few weeks ago to $5,000 now). Here: "Better Intelligence Info Supports Higher Tempo Of US Operations In Iraq " Should we plug Alaska's fiscal gap with part of the permanent fund dividend? Former Governor Hickel thinks so, according to this Associated Press story from the Fairbanks News-Miner:Hickel: Use dividends to deal with state budget. His suggestion is to take half the money used for the dividend and give it to local governments. "The community dividend could be used at the discretion of local governments, or residents could vote on what projects to fund, he said." 7/28/2003

States deficits a drag on recovery The state budget crisis is slowing down the economic recovery according to Louis Uchitelle in a story in today's New York Times:Red Ink in States Beginning to Hurt Economic Recovery

..."It is reasonable to think that the response by the states to the fiscal crisis is taking at least half a percentage point out of the growth rate of the national economy," said Nicholas Johnson, director of the State Fiscal Project at the Center on Budget and Policy Priorities in Washington. The annual growth rate has averaged 2.6 percent for the last 15 months." 7/27/2003

Internet reduces transactions costs, encourages barter Today's New York Times carries a story by Warren St. John on the vogue for bartering: Let's Make a Deal: Barter in a No-Cash Economy. Nice overview of the tradeoffs of barter vs. cash transactions. For example, barter is somewhat more information intensive that cash transactions:

Reached by telephone, the dominatrix, who asked not to be identified, said she had traded successfully for an accountant, movers and housecleaners. She had this advice for prospective barterers: "You need to be incredibly specific in your ad ó spell it out like you're talking to a child. Otherwise, your mailbox will be flooded with stupid questions." " Alaska's state pension fund stressed Tom Moran of the Fairbanks News-Miner reports that the falling stock market, and rising health care costs, have left the Alaska Public Employees Retirement System a little short, here:Alaska's pension fund short Municipalities may have to fill gap

To deal with the deficits, the state plans to dramatically increase the amounts that communities and other entities will have to contribute to the plans, adding to the problems many already face due to the loss of state revenue sharing..." 7/26/2003

The Alaska income-sales tax debate Sean Cokerham reports on the Alaska Municipal League's interest in an income tax in today's Anchorage Daily News, here: Income tax gets a push. He quotes extensively from Mike Hawker, co-chair of the Alaska House Ways and Means Committee:

Lawmakers argue that a sales tax would be fairer because it is a tax on consumption and, unlike under an income tax, most would pay something to support the government. Hawker, co-chairman of the House Ways and Means Committee, opposes a state income tax. A system that includes Permanent Fund dividend checks and a sales tax is fairer, he says. The dividend helps lower-income residents most, he said, and balances criticism that a sales tax weighs unfairly on the poor." P.S. (7-27): The Fairbanks News Miner also reports, here: "Municipal League backs state income tax". The Miner notes that the League's backing wasn't the result of a formal vote, but of an informal poll, and that a formal vote is due in November. Brad DeLong population postings I'd like to draw your attention to three new postings on population growth at Brad DeLong's web site. The first, Crude Life Expectancy Estimates leads off with a striking figure reminding us how radically different the times we live in are from all of those that have gone before. Given the scales used, the estimated average world life span is almost flat in the low 20s from 0 to 1800 AD and then shoots upward almost vertically, reaching the mid-60s in 2000. The idea that the natural life span for a man or woman is 60-70 years, would not have made sense to anyone before the last century. The figures are also broken out by country and region in a second figure. I note that, while India and Africa appear to be at the bottom at any point in time, life spans in both have risen in this century from the area of 20 years to something on the order of 60 years - almost a three fold increase in life spans in a hundred years. I posted a few days ago on the economic stagnation and decline in sub-saharan Africa since 1975. DeLong's figures appear to be based on data points in 1950 and 2000 and would not show a decline since 1975 unless it was greater than the increase from 1950 to 1975. Russian life spans, which rose rapidly between 1900 and 1950, essentially flattens out between 1950 and 2000 - in this respect behaving differently from those in any other region. You could skip the second posting, because it's gist is repeated at the start of the third. DeLong leads off with a figure showing the relation between income and population growth since 1820: "The Demographic Transition". Population growth rates rise with income up to somethign on the order of $1,100 (1n "1990" dollars) and then more or less levels off. Once incomes reach $4,000, population growth rates begin to decline. The third posting, "Notes: In the Shadow of Malthus" contains the argument and the punchline. DeLong's income and growth figure leads him to conclude that a population with an income level of $660 would be growing at an annual rate of something like 0.2% or so. A chart of estimated world human population growth rates since 2,500 BC suggests that it wasn't until about 1800 and after that population growth rates exceeded this level. His conclusion, before 1800 humans lived on something like $660 a year. I don't have an intuitive feel for the dollar measures, so I have difficulty visualizing what this means. DeLong offers this assistance:

7/25/2003

Alaska Municipal League prefers income to sales tax Timothy Inklebarger reports on this week's joint meetings of the Alaska Municipal League and the Alaska Conference of Mayors in today's Juneau Empire, here: JuneauEmpire.com: State & Regional: Cities to push income tax 07/25/03 Alaska has to do something, as its financial reserves dwindle year by year. The legislature almost adopted a sales tax this past Spring. But the League would prefer an income tax. A state sales tax would compete with city and town sales taxes. Kevin Ritchie, the League's executive director pointed out that revenues from an income tax would come from non-residents to a greater extent - both because of payments by out-of-state workers, and because of Federal tax deductions. Inklebarger quotes Governor Murkowski's aide John Manly, who says the Governor favors a sales tax solution and would likely veto an income tax.

"You are taking away money that one person earned to provide services that another person thinks they need," Manly said, noting that Murkowski likely would veto an income tax bill if one passed the Legislature. "It's an old debate that centers around class warfare," Manly said. "They think rich people shouldn't be able to get rich. ... If they think that's progressive, I guess I don't." " Negative externality generating summer rental The Cape Cod Times (which I used to deliver) reports that: Party houses strain neighborly relations (July 25, 2003). The Times tells the story of a quiet year-round neighborhood in Hyannis with a house rented by college students as a temporary residence while they pursue their summer jobs. The house generates noise and garbage which the neighbors find offensive. Although there are small numbers of persons involved, and they know each other - and the scenario is repeated each year over several years - a negotiated solution doesn't seem to evolve. 7-26-03: For a negotiated solution to emerge, property rights must be clearly defined. In this case they may not be. While the law requires the students to keep quiet, there doesn't seem to be any way for the home owners to sell their interest in that quiet. So the college students cannot cmpensate the homeowners. Moreover, the article makes it clear that the town of Barnstable is unable to enforce the noise ordinances in this case. I get the impression that the students and the landlord are unable to make binding commitments to be quiet that would allow the homeowners to pay them to be quiet. First, I assume that the college students turnover from year to year - and the article makes it sound like from week-to-week or even day to day. Second, the landlord says he has trouble getting his tenants to comply. Moreover, as noted, the town of Barnstable can't enforce the noise ordinances. This measn that even if the tenants or landlord agreed to be quiet, the municipality couldn't enforce the agreement. An Ashcroft joke At Mark A. R. Kleiman's blog, here: "A STORY MAKING THE ROUNDS, REPORTEDLY FROM PLAYBOY". Stuart Buck's cognitive biases Stuart Buck reports on his emotional response to alternative motel/breakfast pricing schemes, here: "Another Economics Puzzler". Price discrimination and privacy It makes sense that these issues would be tied together - price discrimination is more effective the more the discriminator knows about the customers (the less privacy they have). Stuart Buck posts on an article by Andrew Odlyzko of the University of Minnesota titled, "Privacy, Economics, and Price Discrimination on the Internet," here: "Privacy vs. Price Discrimination". EU regulations Cronaca also reports on European Union (EU) safety regulations applicable to tightrope walkers, here: "More regulatory madness from the EU". Americas settled 18,000 years ago? Cronaca quotes from a story in today's New York Times, here: "Settlement of the Americas: 18,000 or 30,000 years ago?". It's amazing how they can figure these things out:

After much search, a team of geneticists has now detected a change in the DNA sequence of Siberian men's Y chromosomes that took place just before the first of the two migrations into the Americas. They estimate that the DNA change, called M242, occurred 15,000 to 18,000 years ago, meaning the Americas must first have been occupied after that date. The DNA change is not in a gene and makes no known difference to the men who carry it." If humans migrated to North America 15,000 to 18,000 years ago, it seems less likely that humans were responsible for the North American large mammal extinctions 11,000 to 12,000 years ago (this is the story that humans erupted onto the continent, rapidly hunting a number of large species to extinction. 7/24/2003

Kindleberger Obituary Another obituary of Charles Kindleberger, this one by economist Peter Temin, posted to "Prestopundit.com", here: "Economic historian Charles Kindleberger has died. Here's the EH.NEWS posting:". The impact of the deficits on savings and future income William Gale of the Brookings Institution testified before the House committee on the budget today (testimony here: "Perspectives on Long-Term Budget Deficits"). Here's the part about the deficits, savings, and future income:

Much of the public debate focuses on how deficits affect interest rates. The impact on interest rates can be an important channel through which deficits matter. But the debate about interest rates is--or should be--considered a sideshow. Persistent deficits reduce national saving and therefore hurt the economy even if they do not affect interest rates. regardless of whether interest rates rise. Nor does it matter if the deficit is completely financed by capital inflows. For example, even if capital flows in to offset the deficit, that only implies that domestic production does not fall. But since Americans would own fewer claims on that production, since they borrowed from abroad, their income would still fall." What's the best way to explain comparative advantage? Peter Gallagher tells how he does it, here: "Comparative advantage ". I learned about this from Arnold Kling, here: "Comment of the Week". Found and lost Stanford economist Michael Boskin appeared to have made a new contribution to the federal deficit debate by identifying undercounted future revenues on the order of $9-$19 trillion dollars by 2040. These would have come from taxes on pensions, IRAs, and other tax deferred accounts. Boskin's paper (apparently never more than a draft) may be found here: "Deferred Taxes in the Public Finances". A skeptical blog posting by Mindles Dreck, reporting on the study, may be found here: "Found: $12 Trillion". My understanding is that a draft of the study has existed since January 2003 and that the recent publicity dates to a June 16 story in Barrons. If Boskin were right, it would mean that federal deficits would not be as large as currently projected. Although I assume that there would still be a concern - the Center on Budget and Policy Priorities (CBPP) projects a $4 billion deficit over the next ten years, here, and deficit projections don't really begin to explode (because of medicare and social security) until after that. But he isn't right. Alan J. Auerbach, William G. Gale, and Peter R. Orszag produced this Brookings Institution paper by mid-July: "Reassessing the Fiscal Gap: Why Tax-Deferred Saving Will Not Solve the Problem". The abstract reads:

This posting draws heavily on this by Max Zawicky: "BOSKIN BUNGLES". Paul Krugman Tyler Cowen at the Volokh Conspiracy posts on "What economists really think of Paul Krugman ". Cowen also speculates on who should receive the Nobel Prize in economics, here: "Nobel sweepstakes". 7/23/2003

African Economic Tragedy Elsa Artadi and Xavier Sala-i-Martin think the "worst economic disaster" of the 20th Century was "the dismal economic growth performance of the African continent." (Artadi, Elsa V. and Xavier Sala-i-Martin, "The Economic Tragedy of the XXth Century: Growth in Africa." National Bureau of Economic Research. Working Paper 9865. July 2003. Accessed at http://papers.nber.org/papers/W9865 on July 23, 2003). Per capita income growth over the period 1960-2002 was trivial. Continental per capita GDP grew from US$1,500 in 1960 to about US$2,000 in 1980, and then sat there. Sub-Saharan per capita GDP has actually fallen since the oil crisis in 1974, and is now very close to what it was in 1960. (things have been a little better, but not much, in the late 1990s and early 2000s). Poverty has increased both relatively and absolutely. While people with higher incomes have generally held their own, or made some progress, people with lower incomes have tended to lose ground. The resulting increasing income inequality has increased relative poverty. But poverty has also increased - dramatically - in absolute terms! Using a World Bank poverty definition of $1.00 of consumption per person per day, the percentage of persons in poverty for Africa as a whole increased from 42% in 1970 to 50% in 1995. For Sub-Saharan Africa, the poverty rate rose from 48% in 1970 to 60% in 1995. Things may have gotten modestly better since 1995. The numbers in poverty have increased from 140 million in 1975 to 360 million in 2000 - at a time when the overall world poverty rate fell from 1.3 billion to 900 million.

The authors have a lot of ideas: low investment rates, low starting education levels, poor health, a tropical climate, economies closed to international trade, high levels of government consumption in proportion to GDP, lots of wars. Two items were particularly interesting:

Don't do it yourself! John Downen on the problem with self-sufficiency, at Tech Central Station, here: "The Route to Poverty ". Why specialization is good. I learned about this column at "Prashantkothari.com". Was Harry Dexter White a spy? Harry Dexter White was Under Secretary of the Treasury in the Roosevelt Administration. He and John Maynard Keynes designed the post-WWII international financial institutions (in the Bretton Woods negotiations). The world they built lasted intact into the early 1970s, and some parts of it (the World Bank and International Monetary Fund) remain important today. He was also, probably, a Soviet spy. Brad DeLong weighs the evidence, here: "Marking My Beliefs to Market: Soviet Espionage in America: Harry Dexter White". Which is better: bilateral or multilateral trade agreements? Juan Non-Volokh draws attention to the debate, and points to a letter to the editor in yesterday's Wall Street Journal, here: "In Search of Free Trade". 7/22/2003

"The Way We Were" Brad DeLong presents, and analyzes, an Atlantic Monthly article from 1905 by one "G.H.M." on what a college professor needed to make to live an acceptable, upper middle class lifestyle, here: "What Should College Professors Be Paid?". Life was very different then.

Yet according to GHM the average college professor stood in 1905 in roughly the same relative position in the distribution of income in America then as somebody in roughly the 99.5 percentile does today... " The industrial revolution "democratized" consumption (maybe a someone can comment below and tell me who first used that term). The John Masefield poem, "Cargoes" (all three verses, here) illustrates the point. The poem contrasts ships and cargoes from different eras:

Dipping through the Tropics by the palm-green shores, With a cargo of diamond, Emeralds, amethysts, Topazes, and cinnamon, and gold moidores. Dirty British coaster with a salt-caked smoke stack, Butting through the Channel in the mad March days, With a cargo of Tyne coal, Road-rails, pig-lead, Firewood, iron-ware, and cheap tin trays" This posting is based on one by Arnold Kling, here: "Income over Time". Iraq Post-war planning By all accounts, the rebuilding process in Iraq has been rocky. Recent articles suggest that problems with pre-war planning are one reason why. Phil Carter at Intel Dump has had two recent posts on Iraq pre-war post-war planning. The first, on July 18, linked to and quoted from an L.A. Times article on the planning process, and provided some commentary, here: "Planning for success?". The direct link to the Times is here: "Preparing for War, Stumbling to Peace" (free registration may be required). The Times article has a lot of insights into the bureaucratic constraints on the development of the post-war plan. Planning was centered in the Pentagon from the fall of 2002 on. The article suggests that Pentagon planners failed to draw effectively on work that had been ongoing at State since the spring, that there were problems drawing on expertise available in other federal departments, that the planners didn't draw on as wide a range of Iraqi input as they might have, that key assumptions were wrong, that they didn't have much time, and that the failures of U.S. diplomacy before the war created unexpected problems. This article sounded to me like a State Department critique of the Defense Department's planning effort. Carter's second posting today, "Did we plan for success in Iraq?" draws on more sources and has more analysis. Carter tentatively concludes that, while we knew what needed to be done because of other nation-building exercises, we didn't do it. Perhaps because the Pentagon traded off the post-war planning effort for the advantages of striking quickly, perhaps because we underestimated the problems. I like his close:

World Bank and privatization The Wall Street Journal carried a column by Michael Phillips yesterday (7-21, "The World Bank as Privatization Agnostic," page 2) reporting on changing attitudes toward privatization at the World Bank. The Bank has promoted privatization of public utilities such as telephone, electric, and water systems, as a development tool. However, unexpected economic results and political opposition in client countries are causing people at the Bank to rethink. My impression from the article is that electricity and water especially are often so highly subsidized as government operations, that privatization leads to large price increases. These are costly to consumers, impose a big burden on the poor, and create widespread opposition to the privatization. The political problems make investors leery of putting money into the private operations. But make up you own mind abot what it says. Brad DeLong quotes extensively from the column here: "The World Bank Starts Rethinking Utility Privatization". Charles Kindleberger Robert Samuelson talks about the late Charles Kindleberger in his Newsweek column this week. Available here: "A Renegadeís Wise Lessons ". A visit to SE Alaska Laurie Snyder, Slate copy chief is spending a week fishing in Southeast Alaska. She is reporting on it in the Slate "Diary" feature, here: "Laurie Snyder, Slate's copy chief, is spending the week on a fishing boat in Southeast Alaska." Monday she arrives in Juneau and comes face to face with a black bear (too - see the end of my previous posting). 7/21/2003

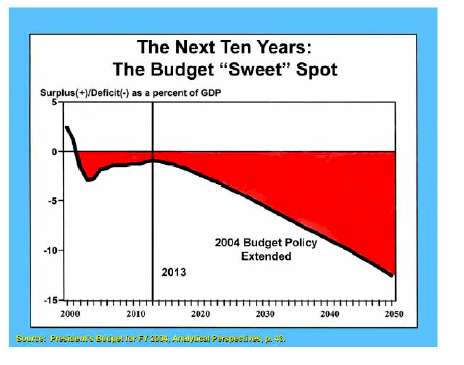

Medicare, Social Security and the budget On July 11, I posted a note on 10 year budget deficit projections prepared by Richard Kogan of the Center for Budget and Public Priorities (CBPP), here: "Upcoming Federal Budget Deficits". Kogan and Robert Greenstein of the CBPP have a more recent short report on the federal budget, here: "SANITIZING THE GRIM NEWS: The Administration's Efforts to Make Harmful Deficits Appear Benign". This new report contains a figure, taken from the Office of Management and Budget (OMB) February budget documents, projecting deficits out to 2050:  Any projections over this period have to be taken with a grain of salt. Nevertheless, the diagram is suggestive, and sobering. The most important reasons for these large deficit projections are large projected increases in Medicare and Social Security. These are due to an aging population, and increases in the cost of medical care. A July 17 Wall Street Journal column by Jagadeesh Gokhale and Kent Smetters, available at the American Enterprise Institute, here: "How to Balance a $43 Trillion Checkbook", sheds some light on the sources of the deficits. The column itself is apparently based on a short new book by Gokhale and Smetters, available as a pdf file, here: Fiscal and Generational Imbalances. New Budget Measures for New Budget Priorities. The article argues for a new approach to federal budgeting. In the course of the argument, Gokhale and Smetters provide estimates of the present values of Medicare and social security fiscal imbalances. These are large numbers:

The Gokhale and Smetters study is based on work the authors began for Treasury Secretary O'Neill last year. It was briefly controversial in May. I posted on it then, here: "Treasury Tax Study" As I worked on this this evening a black bear walked up to the window I'm facing (two feet or so away), stared inside for a verrrry long moment, and then walked back into the woods. 7/20/2003

Kindleberger and Krutilla Charles Kindleberger of MIT died on July 7. The Washington Post obituary is here: "MIT Economist Charles Kindleberger"

John Krutilla, long associated with Resources for the Future (RFF), died on June 27. Krutilla was a key figure in the development of environmental economics. Writers like John Muir and Aldo Leopold had described the ethical and aesthetic importance of pristine natural environments. Krutilla showed how to bring the values associated with pristine environments into the economic analysis of natural resource management. RFF has prepared a nice memorial for Krutilla, at its website, here: "John V. Krutilla, Economist & Creator Of Modern Natural Resource Conservation Theory". You will find:

7/18/2003

Dealing with congested roads The Reason Public Policy Institute blog, Out of Control (devoted to investigating opportunities for welfare-enhancing privatization of government functions), draws attention to an exciting private toll road in California, in "Are toll roads safer?". The toll road organization - "91 Express Lanes" has a web site, here: "91 Express Lanes" In 1995, the 91 Express Lanes opened as the first privately financed toll road in the U.S. in 50 years - in the median of "California's Riverside Freeway (State Route 91) between the Orange/Riverside County line and the Costa Mesa Freeway (State Route 55)." See the "91 Express Lanes" website above for a photo - and a virtual drive along the road. I gather from the website that the road was an initiative of the Orange County Transportation Authority (OCTA). In the early 1990s, Route 91 was congested and public funds were not available for the construction to relive that congestion. OCTA turned to private financing to develop the road - the exact mechanism is unclear from the site. Construction to relive congestion is everyone's first idea. What's more interesting here is the use of tolls to control congestion, and the optimization of the toll system to deal with varying congestion conditions through the day and week. There are no toll booths:

Tolls vary by day, by hour, and by east or westbound lane. You can see the toll schedules here: "91 Express Lanes Toll Schedules". The demand for the road fluctuates throughout the day and week, and so do tolls. As rush hour in the inbound lane begins, tolls gradually rise from $1.00 to a peak of $3.60 between 7 and 8 AM, and then gradually fall to $1.70 for the rest of the day. All the tolls apparently automatically billed. The web page claims these benefits:

Mayo v. Satan and His Staff "Mayo v. Satan and His Staff". Thanks to Eugene Volokh at the Volokh Conspiracy for the reference. Volokh's blog posting has a short commentary: "Mayo v. Satan and His Staff". 7/15/2003

New, Higher, Administration Deficit Estimates Jonathan Weisman of the Washington Post reports that the Administration has increased its estimates of the federal budget deficit, here: "White House Foresees 5-Year Debt Increase Of $1.9 Trillion".

"The White House Office of Management and Budget officially pegged the 2003 budget deficit at a record $455 billion, up sharply from $158 billion in the fiscal year that ended Sept. 30, 2002. It is expected to rise to $475 billion in fiscal 2004, even without additional costs for the occupation of Iraq. The deficit is then expected to dip swiftly to $213 billion in 2007 before rising again in 2008, the last year of the White House forecast..." Kogan starts with Congressional Budget Office (CBO) projections from January 2001 of a $360 billion surplus in FY2003. This estimate didn't take account of the recession, which began in March 2001. Had the CBO accounted for the recession, Kogan figures the FY 2003 deficit would have been projected to be -$30 billion. This implies that the recession was responsible for $390 billion of the shift from surplus to deficit in FY 2003. These estimates don't take account of the tax cut bills, which add $205 billion to the FY 2003 deficit, non-war spending increases, which add $80 billion, or war related expenditures, which add $90 billion. Total deficit - -$405 billion. These calculations are laid out in his July 8 report, "WAR, TAX CUTS, AND THE DEFICIT". Kogan's calculations have now been made obsolete with the administration estimate of an FY 2003 deficit of -$455 billion. Both Kogan and the administration calculated larger deficits for FY 2004. The shift from a projected $360 surplus to a projected $405 deficit is a shift of $765 billion. Kogan's figures suggest about half is due to the recession. About 27% is due to the tax bills. About 12% is due to the war. A deficit may be appropriate given the need for fiscal stimulus to get us out of recession. More worrisome is the fact that the deficits aren't going away. Weisman reports in the Post that

"We are truly in a structural deficit as it's usually defined," said Rudolph G. Penner, a Republican and former director of the Congressional Budget Office, "and this is not going to right itself." " 7/14/2003

New budget blog OMB Watch announces a new blog dealing with federal budget issues. You can access it here: "Federal Budget Weblog". OMB Watch does just what its name says, monitoring budget, regulatory, and information activity at the Federal Office of Management and Budget (OMB). Their bi-weekly email newsletter (available here: "OMB Watcher") is very useful, albeit with a liberal orientation. They've recently acquired Amherst College economic blogger John Irons - whose own blog, independently produced, may be found here: ArgMax. The Watch's new blog will focus on budget issues. Maybe if it is a success they will follow up with a blog on regulation. Important insight into the Niger-Iraq uranium connection Thanks to the Volokh Conspiracy for its report: "Letter From Niger". 7/13/2003

More, longer, eulogies Friday's Wall Street Journal has a short column by Jeffrey Zaslow pointing to changes in funeral eulogy patterns in the U.S.

7/12/2003

Check Forgery, 2003

7/11/2003

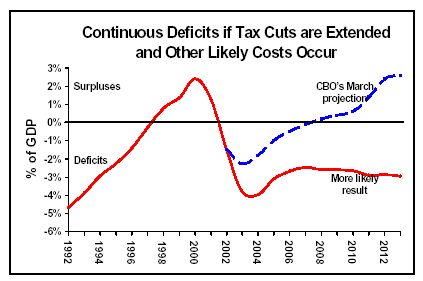

WTO rules agains U.S. on steel tariffs Asymmetrical Information reports that the World Trade Organization (WTO) has just ruled against the U.S. on the Administration's steel tariffs. This could be good for us, or it could be bad, as Jane Galt explains. Brad Delong reports on the decision, here: "WTO Says U.S. Steel Tariffs Are Illegal". Read the debate in the comments about whether or not taking an action you know the courts will strike down is an unusually duplicitous tactic, given contemporary U.S. political ethics and practice. Lunch is over, back to work. Air quality is getting better Lynne Kiesling says to read this article on air quality by Joel Schwartz at Regulation magazine: "Clearing the Air" Schwartz's theme is that "Despite negative public perception and misleading portrayals, American air quality has improved dramatically." Upcoming Federal Budget Deficits Richard Kogan of the Center on Budget and Policy Priorities (CBPP) has a short report projecting federal budget deficits for the next ten years (here: "$300 Billion Deficits, As Far As The Eye Can See".). Kogan summarizes his results in this figure:  Kogan starts with March Congressional Budget Office (CBO) budget projections (summarized in the blue line) and then adds in: (a) items that the CBO is prevented by law from considering, and (2) the likely impacts of events since March. The "add ins" include:

7/10/2003

Changes at the Treasury Department The New York Times reports this morning that the first woman, Susan C. Schwab (currently dean of the University of Maryland School of Public Affairs) has been named to the #2 spot in the Treasury Department - Deputy Treasury Secretary. The deputy secretary runs the day to day affairs of the Treasury allowing the Secretary to "focus on policy" and serve as "an economic spokesman for the administration." In a second change, Assistant Secretary for Finance Peter Fisher will be replaced by Kenneth Leet, from the investment bank of Goldman Sachs, in October. The Times story mentions both changes, but devotes itself almost entirely to the Fisher/Leet switch. The story provides a good opportunity to learn something about the things an Assistant Secretary for Finance does: "High Official Quits Treasury and Woman Is Named No. 2"

"He was at the center of other important policy decisions as a member of both the agency that insures pensions and the Air Transportation Stabilization Board." The Washington Post story is here: "Nominees Picked for 2 Key Posts At Treasury". 7/9/2003

New Chief Economist at the IMF The Washington Times has a column by Bruce Bartlett on new IMF chief economist, Raghuram G. Rajan of the University of Chicago, here: "Fresh breath of free market air".

Rajan's web page may be found here: "Rajan UofChicago Web Page". Here's his picture from the site:  At the website "Rediff.com" you can find a column on Rajan and his appointment by Paranjoy Guha Thakurta, "Raghuram Rajan: An economist with a difference".

"He is not only the youngest individual to hold this position, but also the first from a developing nation. "Co-author of the book Saving Capitalism from the Capitalists (Crown Business, New York, 2003), Rajan has apparently sought to steer clear of the ideological position espoused by the extreme-right Chicago school of economists. "Though he is a firm believer in the virtues of a free market system, he has nevertheless been extremely critical of capitalists who, to use his words, "in their continuous quest for government protection against competition often turn out to be capitalism's worst enemies." "Now at a relatively young age of forty, Rajan's rise in the world of academia has been truly spectacular..."

7/2/2003

"Why isn't the Bush Administration doing what is in its own interests?" DeLong asks At this point, the persistent high unemployment is at least partly the fault of the Bush Administration. DeLong notes that

The curse of a generous natural resource endowment You'd think that a large endowment of mineral and oil wealth would be a blessing for a country. But often it isn't. "It isn't" often enough that economists have begun to speak about the "natural resource curse." That is, natural resource curse as in: "Addressing the Natural Resource Curse: An Illustration from Nigeria," a new National Bureau of Economic Research working paper (Working Paper 9804, accessed at www.nber.org/papers/w9804 on July 2, 2003) by Xavier Sala-i-Martin and Arvind Subramanian. In summary: Since the mid-1990s economists have begun to identify an inverse relationship between resource endowments and economic growth. Various theories have been advanced to explain this, including: (a) political competition for the income from natural resource exploitation leads to corruption and general institutional disorder, and through this means undercuts growth rates; (b) income from natural resource commodities is volatile, and this undercuts growth; (c) "...natural resource ownership makes countries susceptible to Dutch Disease - the tendency for the real exchange rate to become overly appreciated in response to positive shocks - which leads to a contraction of the tradable sector. This outcome, combined with the (largely unproven) proposition that tradable (usually manufacturing) sectors are "superior" because learning-by-doing and other positive externalities..." undercuts growth. Sala-i-Martin and Subramanian address this issue by reviewing statistically the experience of a large cross-section of countries. They conclude:

Upcoming disaster in Cancun Jagdish Bhagwati (Columbia professor and noted international trade economist) thinks the upcoming ministerial meetings of the World Trade Organization in Cancun in September may be problematic in the way the 1999 ministerial meetings in Seattle were problematic. The Seattle meetings collapsed because of a poorly prepared agenda inside and widespread rioting outside. Bhagwati is worried because the current trade negotiations are in disarry, Cancun will provide a hospitable environment for protesters, and the U.S. is not providing necessary leadership. Recall that WTO members are currently negotiating reductions in trade barriers - with a particular focus on efforts to help developing nations (see my post "A Tale of Three Cities" Bhagwati writes on the editorial page of today's (7-2) Wall Street Journal - "The Caravan to Cancun." Some of his points - Cancun will provide a fertile ground for protest: (1) it is easy to get to [and although Bhagwati doesn't say so, its an agreeable place to go - Ben], (2) "Mexico has a tradition of activist students...", (3) "Mexico is rife with fanciful arguments linking the ills in Chiapas to Nafta.", (4) U.S. agricultural subsidies and Nafta agricultural liberalization have created "political fallout" within Mexico, (5) symbol-wise, the host, Mexican President Vincente Fox, used to be a Coca-cola executive, and (6) "The frustrated antiwar movement is allying with the anti-globalizers." The ministers are are also in disarry going into Cancun. The negotiations are already behind on what is an unreasonable ambitious time line. Major issues for this negotiations process - agricultural liberalization and reforms that would allow poor countries to get less expensive access to medical drugs - are stymied, or moving slowly. In the case of reform of intellectual property rights to get less expensive drugs to poor countries, it is the U.S. that is holding up an agreement. U.S. leadership is essential but underperforming. The U.S. is wasting its energies on a large number of country-to-country trade negotiations "...adding to the maze of preferences that blight the trading system..." instead of focusing on moving ahead comprehensive multilateral trade negotiations within the WTO framework. |