Ben Muse |

|

|

Economics and Alaska To leave a comment click on the word "comment" at the end of each post. Click here for Atom feed Juneau webcams

Alaska/Yukon photos

Race for World Bank PresidentThe Fight for Free Trade

Economics blogs

Australian economics bloggingCanadian economics bloggingUK economics bloggingViennese economics bloggingSports economics blogsTax blogsOther blogs

Economic Columnists

Journals OnlinePolicy Essays and Papers

Archives

Where are visitors to this page? (Auto-update daily since 12-27-04) |

1/29/2004

What does science say? Chris Mooney explains how to undercut scientific results that undermine your case, here: "Paralysis by Analysis"

Having a lot of money helps with all three steps." 1/28/2004

The "oil wealth" trajectory Abiola traces out a common trajectory for countries discovering oil: "The Problem With Oil Wealth ". He concludes:

Amazon as an investment John Quiggin calculates Amazon's P/E ratio: "Amazon finally has a P/E ratio". Predicting levels of regulation The National Bureau of Economic Research (NBER) has released a working paper by Casey B. Mulligan and Andrei Shleifer arguing that the level of regulation in a jurisdiction is related to the size of its population. The abstract:

How many consumption options do we really need? Tyler Cowen engages Barry Schwartz of the New York Times in debate about whether having more options or choices is really better: "In defense of choice". Cowen is the man for whom 432 different cheeses in a single supermarket are not enough: "The best argument for spam I have yet heard". 1/27/2004

Drezner collects links on outsourcing Daniel Drezner has linked to, and excerpted, several useful articles on outsourcing. In "Dissecting the outsourcing hypothesis" he links to and cites from a Clay Risen piece in the New Republic titled, "Is Outsourcing Really So Bad? Missed Target." Risen makes a number of points; the most important to me is that outsourcing generates productivity gains and competitive advantage:

Indeed, recent studies delving beyond the Forrester and Gartner numbers indicate that, despite the impact of short-term job loss, offshore outsourcing represents a net economic benefit for the United States. According to the McKinsey Global Institute, for every dollar a U.S. company spends on offshoring to India, the U.S. economy gains $1.14, thanks to a number of factors: savings from the increased operational efficiency, equipment sales to Indian outsourcers, the value of American labor reemployed to higher-wage jobs, and repatriated earnings by U.S. companies that own Indian outsourcing firms. "The recent changes driving offshoring are not that different or radical from the changes that dynamic, competitive, technologically evolving economies have experienced for the last few decades," the report concludes..."

And therein lies the opportunity for Americans. It's inevitable that certain things - fabrication, maintenance, testing, upgrades, and other routine knowledge work - will be done overseas. But that leaves plenty for us to do. After all, before these Indian programmers have something to fabricate, maintain, test, or upgrade, that something first must be imagined and invented. And these creations must be explained to customers and marketed to suppliers and entered into the swirl of commerce in a fashion that people notice, all of which require aptitudes that are more difficult to outsource - imagination, empathy, and the ability to forge relationships. After a week in India, it seems clear that the white-collar jobs with any lasting potential in the US won't be classically high tech. Instead, they'll be high concept and high touch. Indeed, Kirwin, the programmer in Delaware, partly confirms my suspicion. After he lost his job at J.P. Morgan, he collected unemployment for three months before he found a new job at a financial services company he prefers not to name. He's now an IT designer, not a programmer. The job is more complex than merely cranking code. He must understand the broader imperatives of the business and relate to a range of people. "It's more of a synthesis of skills," he says, rather than a commodity that can be replicated in India..." How to lead people Scheherazade has some advice that I imagine would be useful to a person who wanted to lead a team in a common effort: "Big Picture". If the team members are going to show any initiative at all (and contribute creatively to the success of the effort), you'd have to put them in the big picture as Scheherazade suggests. Nigerian scam letters Abiola posts on Fred Ajudua, Nigerian scam artist, serving time in prison for defrauding a Dutchman of $1.7 million. Some useful comments on the psychology of those letters: "How are the Mighty Fallen". See also "Book 'em Obasanjo! - A Nigerian Scam King Jailed" at far outliers. 1/26/2004

John Wall visits Alaska John Wall visited the area around Juneau in 1999, and created this extraordinary web site to document his vacation: "Alaska 1999". I've done the "Pack Creek by kayak" trip, but I haven't done the Yakutat trip or the whale watch (I understand many people in New York haven't been to the Statue of Liberty). He came back to Southeast Alaska in 2001: "Alaska 2001" (the Juneau area again) and 2003: "Kanga Bay" (using Sitka as a base). 1/25/2004

"Remarks by the President to the press pool" Here: "Remarks...". Thanks to Donald Sensing at One Hand Clapping for the link: "Want some ribs? Yes or no.". P.S. 10 PM Dan Froomkin gives some context for Bush's remarks, here: "Bush Explains the Economy, Ribs the Press Corps".

According to print pool reporter Jim Lakely of The Washington Times, "POTUS's arrival caught the restaurant workers and patrons by surprise. POTUS entered and immediately shook hands with some elderly patrons, and soon worked his way behind the counter." Following is the full text, as recorded by the White House, of the ensuing exchange with White House correspondents David Gregory of NBC and Terry Moran of ABC. Gregory is one of several people in the press corps Bush calls "Stretch."... ...One final note from the pool reporter: While none of the reporters took Bush up on his offer to buy ribs themselves, someone from the front of Air Force One eventually sent a few back to the press area, shortly after take off. But there was not enough for everybody." 1/24/2004

Computerized voting Paul Krugman pointed to the potential problems with computerized voting systems in yesterday's New York Times: "Democracy at Risk". How do you do a recount when there is no paper trail?

The monsters among us, and their victims Tomorrow's New York Times Magazine has a very disturbing story: "The Girls Next Door". The story, by Peter Landesman, deals with sex slavery in the United States.

As an example of the sophistication of the psychological manipulation, Landesman explains the why older women are crucial to the operations of the slave rings:

This mirrors the tactics of the Eastern European rings. ''Mexican pimps have learned a lot from European traffickers,'' said Claudia, a former prostitute and madam in her late 40's, whom I met in Tepito, Mexico City's vast and lethal ghetto. ''The Europeans not only gather girls but put older women in the same houses,'' she told me. ''They get younger and older women emotionally attached. They're transported together, survive together.'' " FDA Commissioner McClellan Gina Kolata has a profile of Dr. Mark McClellan, the economist who heads the FDA, in today's New York Times: "Many Surprised by Bold Moves at the F.D.A.". The thrust of the story is that, while business constituencies are pleased with his performance, activists have also been pleasantly surprised. Kolata makes the interesting observation that, "...even industry groups that appear to have been hurt by some of Dr. McClellan's decisions speak well of his approach to the job."

She said her group wanted the agency to stop supplement makers from making false health claims or flouting good manufacturing practices, and supported the ephedra ban. Others regulated by the F.D.A. like the attention they are getting. Dr. Rhona Applebaum, the executive vice president and chief scientific officer of the National Food Processors Association, said that in her 20 years in the industry, she had never seen an F.D.A. commissioner pay so much heed to food. "So yeah, we're pretty excited," she said." The Boston Globe profiled McClellan a few days ago: "The economist who heads the FDA". The Globe'sapproach was a little different. While basically a personal profile, the Globe led of its story by strongly contrasting drug industry approval of McClellan, with activist disapproval:

He shares industry's view that profits should be protected to provide money and incentives to keep the United States at the forefront of new drug development. He is demanding speedier drug approvals from the FDA, echoing long-standing pleas from industry that the agency move faster and more predictably. He is lined up with the pharmaceutical industry in warning about potential health dangers of importing low-cost Canadian drugs. Instead of calling for lower US drug prices, he says, Canada and Western Europe should raise their prices on brand-name drugs to match. "He's really been a disaster, possibly the worst commissioner I've seen," said Dr. Sydney Wolfe, director of health research at consumer group Public Citizen in Washington. "He is more well-liked by the pharmaceutical industry than any other commissioner I can remember." " Why does iTunes charge $0.99/song? Tyler Cowen wonders why, and explores alternative business models, here: "Why 99 cents per song?". Doha in Davos Guy de Jonquieres reports (in today's Financial Times) from Davos on a meeting yesterday by representatives of about 20 World Trade Organization members. The meeting was held in conjunction with the World Economic Forum underway in Davos, and discussed how to get the Doha Round of trade liberalization talks underway again. While the participants "pledged ... to try and reinvigorate the talks...", and "...several participants indicated they were willing to be more flexibile on agriculture and other central issues... the meeting failed to chart a clear way ahead and fought shy of setting any deadlines for agreement." Here: "Abundant good intentions on global trade talks". Another editorial on regulatory science peer review Chris Mooney reports, from his science and policy blog Chris C. Mooney.com, on an editorial from the Atlanta Journal-Consititution opposing the Office of Management and Budget's (OMB's) proposed guidelines on peer review of rulemaking science: "Atlanta Journal-Constitution on Peer Review". DeLong Remembers the NAFTA Debates Brad DeLong was Deputy Assistant Secretary for Policy at the Treasury during the first years of the Clinton administration, leaving in May 1995. You can learn something about his work at the Treasury, here: "What I Did in Washington", and here: "Farewell to Treasury" (the later has some good advice from economist Michael Boskin on how the head of an analytical team should approach the job). So, DeLong is qualified to post, as he did today, on Treasury and Clinton administration mindsets with respect to the justification for the North American Free Trade Agreement (NAFTA), and to anticipation of the Mexican financial crisis of 1994-95. The post is here: "Looking Back at the NAFTA Ratification Debate". Some nice discussions of the relationship between policy analysis and public relations, and on how Clinton's experience as a governor may have influenced his approach to trade issues. On Clinton:

1/22/2004

How Presidents Talk Over at the New Republic, David Kusnet, speechwriter for President Clinton in the early nineties, explores the "rhetorical techniques" Bush used in the State of the Union speech "to defend his record and define his eventual Democratic rival..." For example:

This year's State of the Union had more weasel words ("weapons of mass destruction-related program activities") and less plain-spoken poetry than his earlier speeches. But, still, there were plenty of declarative sentences. ("The terrorists declared war on America, and war is what they got.") And Bush benefits from most people's predisposition to believe that simplicity reflects straightforwardness... Meanwhile, over at Washington Monthly, Mark Katz, a "humor speechwriter" for President Clinton, explores the presidential use of humor, and the different approaches to humor associated with different U.S. political subcultures. Katz was a great believer in using self-deprecatory humor (a tactic Howard Dean is using like mad this week) to defuse the awkward issues; Clinton had a different take:

This was also the symptom of the political culture shock of going from Little Rock to Washington. Clinton was raised in a political culture where gentle, self-effacing humor was all but unheard of, and political humor dinners featured a much meaner brand of funny. In Arkansas, I was told by people who'd know, humor is a stick that you beat other people up with. Clinton kept in his head a running list of the personal hypocrisies, professional double standards, specific unfair shots, and falsehoods uttered against him. He wanted to recite them all, and if they were expressed in the form of a joke, well, that was fine, too. But left to his own devices, the defining tone of his speech to the Washington press corps would be, "Katy, bar the door!"... Tribute to Lillian Moller Gilbreth Over at Slate, Ann Hulbert explores the life of Lillian Gilbreth, mother of twelve and "20th-century America's pre-eminent female industrial-management expert, with more ergonomic (and less idiotic) innovations [than those of a movie character cited in the column - Ben] to her name: among them, the foot-operated trash can, those egg and butter compartments in refrigerators, waste hoses for washing machines, and an oeuvre that includes The Psychology of Management." The mother in the original Cheaper by the Dozen. How did she do it?

And it worked: Lillian Gilbreth was not tied down, physically or psychologically, by that I'm-indispensible-and-all-hell-will-break-loose-without-me mentality that is the trademark of contemporary supermomhood—and that Hollywood plays on in the current domestic-disaster pic version..." Minor changes 1-23-04 1/21/2004

Strange tale of Finnish public finance A Finnish tax official was dead at his work desk for two days before people realized he was no longer auditing returns. Cronaca has the story: "Death and taxes" 1/20/2004

Mene, Mene, Tekel, Upharsin Abiola at Foreign Dispatches evaluates the trade policies of several Democratic presidential candidates, and finds them wanting: "A Strange Enthusiasm". Boys or girls Couples with girls are more likely to divorce than couples with boys, but couples also show a preference for adopting girls. Tyler Cowen discusses ways to reconcile these two observations, here: "Why do parents adopt so many girls?". Problems with online music sales Tyler Cowen posts on the problems posed for online music sales (through outlets such as iTunes) by "high transaction costs, poorly defined property rights, and stubborn holdouts": "Why can't you find your favorite song?". 1/19/2004

Marian Anderson at the Lincoln Memorial On Easter Sunday, 1939, Marian Anderson performed from the steps of the Lincoln Memorial. Anderson, an African-American, had earlier been denied the opportunity to perform at the Daughters of the American Revolution's Constitution Hall. The Roosevelt Administration quickly offered this alternative venue. At the time, Anderson was one of America's leading classical singers, a contralto, at the height of her powers. The following description of the events is taken from an April 2000 Commentary magazine review, by Terry Teachout, of a biography by Allan Keiler: Marian Anderson: A Singer's Journey. Teachout's review is called "The Soul of Marian Anderson." Keiler is a professor of music at Brandeis:

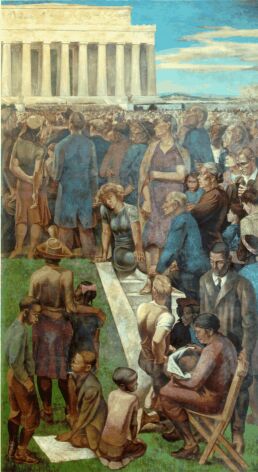

As a result of the Great Depression, the U.S. concert circuit has contracted. The fact that most southern recital halls were off-limits either to Anderson or to black audiences was thus financially disadvantageous as well as morally outrageous. (In 1938, the only Southern state in which Anderson performed was Texas.) Hurok [Anderson's manager - Ben] was understandably eager to find a way to open up the south to one of his most profitable clients, and Washington D.C., seemed to him the most likely place to start. Though Anderson had already sung in Washington under the auspices of the all-black Howard university, Hurok wanted to book her into a larger house before an unsegregated audience. The logical venue was the 4,000-seat Constitution Hall, the city's largest indoor concert space, but the owners, the Daughters of the American Revolution (DAR), enforced a "white artists only" clause in all management contracts, and when Howard University requested an exception for Anderson, the hall's manager refused. The NAACP then stepped in, launching a publicity campaign intended to embarrass the DAR into allowing Anderson to perform at Constitution Hall. But the group stood firm, even after Eleanor Roosevelt publicly resigned as a result of its prosegregation stance. following an abortive attempt to arrange a recital in the auditorium of an all-white local high school, Hurok had the idea of presenting an outdoor concert; Walter White, the NAACP's executive secretary, suggested that it take place at the Lincoln Memorial, and Secretary of the Interior Harold Ickes promptly authorized an Easter Sunday performance. All the players in this drama had agendas of their own. Hurok knew that such a concert would be of incalculable publicity value. Ickes hoped that blacks, who then voted Republican en bloc, could be induced by such symbolic gestures to support the Roosevelt administration. Anderson, who was on tour, disingenuosly claimed that she knew nothing of the controversy until Eleanor Roosevelt resigned from the DAR, but in fact she was fully aware of what her manager had in mind, and by all accounts was terrified by it."  This 1942 Works Progress Administration (WPA) mural in the U.S. Department of the Interior building in Washington, by Mitchell Jamieson, shows the audience at the Marian Anderson concert. For more information, go here: "Interior Building WPA Murals: An Incident in Contemporary American Life". The Lincoln Memorial was only 17 years old when Anderson sang there. The Park Service web site on the Memorial notes that:

The Internet has a rich selection of Marian Anderson resources. The University of Pennsylvannia's comprehensive professional biography, with text, photos, and video and audio clips: Marian Anderson: A Life in Song. The History Channel has a five minute recording of Harold Ickes and Marian Anderson at the Lincoln Memorial: Harold Ickes and Marian Anderson. Randye L. Jones' short musical biography is here: "Marian Anderson (1897-1993)". "Charlayne Hunter-Gault explores the life of an artist with her nephew and a fellow singer on the 100th anniversary of her birthday" in this transcript of a 1997 National Public Radio interview: "A Voice of Hope". The Kennedy Center has several attractive and informative web pages in connection with a play about Anderson, "My Lord What a Morning". This page is biographical: "Marian Anderson: The Woman", and this one has a musical biography: "Marian Anderson: Her Music" The other web resource I've used is the Teachout article which can be obtained from the Commentary magazine electronic archive: "Commentary Digital Archive". Anderson's concert at the Lincoln Memorial, and a subsequent concert in which she became the first African-American to sing at the Metropolitan Opera in New York were important events in the U.S. civil rights movement. But Anderson sang in these places because of her professional achievements. According to Teachout, Kieler's book was written to draw attention to those achievements. Just how bad a president was Warren G. Harding? Matt Herrington reviews John Dean's new biography of Warren Harding: "Is America's So-Called Worst President Unfairly Condemned? A Review of John Dean's Warren G. Harding". Personally honest, he died shortly after the start of the third year of his first term (and following a visit to Alaska) and wasn't there to either (a) clean up after the scandals, or (b) defend himself. Even without Teapot Dome, and even if he had lived, he probably wouldn't have been remembered as one of our better presidents. Harding does seem to have had a modestly progressive attitude towards civil rights:

More concretely, Harding reversed the Wilson Administration's policy of excluding minorities from federal positions. This was, to say the least, heady stuff for the 1920s, and was part of Harding's plan for attracting the African-American vote to the party of Lincoln, and ending the democratic stranglehold on the South..." Is Alaskan government relatively corrupt? This study: "Public Corruption In The United States" ranks Alaska as the fourth most corrupt U.S. state. The ranking is based on data in the 2002 report of the Public Integrity Section of the U.S. Department of Justice (DOJ). The index is total public corruption convictions obtained by the DOJ from 1993 to 2002 divided by the state's population. Thanks to Marginal Revolution (I guess) for the reference. 1/18/2004

Tracking down Confederate deserters Donald Sensing reports on his investigations into the reality of the Confederate home guard units depicted in the recent movie Cold Mountain: "Confederate Gestapo". He concludes that Cold Mountain gave a fairly accurate portrayal of the guard units. P.S. January 23, 2004 Sensing has a follow-up post passing along new information from a historian named Fred Ray, here: "More on the Confederate Gestapo". Ray's notes add nuance to the picture:

The home guard varied wildly in effectiveness (they were, after all, old men & boys). In other theaters, like Virginia, they were quite effective. In fact, if you ignore Teague's brutality for a moment, he is highly effective and always seems to be one step ahead of the deserters. They weren't all like that -- in some areas the guard was utterly ineffective, and in other gangs of deserters and draft dodgers terrorized both the home guard and the populace. The real problem with the home guard was that there was no chain of command -- they were out on their own in very isolated circumstances in a brutal environment, with no supervision... Brad DeLong interview Norman Geras interviews economist and blogger Brad DeLong, here: "The normblog profile 17: Brad DeLong". Thanks to Tyler Cowen at Marginal Revolution for the information about it. The tax cut of 1964 In 1964, Congress adopted signficant tax reductions in response to an initiative from the Kennedy and Johnson administrations. As Brad DeLong describes it in his intermediate macroeconomics text:

In 1961-1962 the unemployment rate was in the range of 5.5 to 6.7 percent. Maybe there was a case for thinking that unemployment was above its natural rate. But by 1965-1966 the unemployment rate was in the range of 3.8 to 4.5 percent, inflation was about to become a serious problem, and Johnson's advisors were already calling for tax increases to try to reduce aggregate demand and control inflation." The Byrd Amendment The Byrd Amendment, passed as part of agricultural legislation in 2000, directs revenues from anti-dumping duties to be paid to the companies that petition for the duty. The anti-dumping duty process is already rigged against importers. I summarized Douglas Irwin's comments on the process (from his book Free Trade Under Fire) a few days ago in a post on the new shrimp anti-dumping petition, here: "Shrimp anti-dumping petition". Paul Kedrosky posts on the Byrd Amendment here: "Repealing the Byrd Amendment". He cites a column of his from this weekend's National Post and provides useful links to Byrd Amendment source material. The World Trade Organization (WTO) has against the Byrd Amendment and other member countries are requesting permission to take retaliatory action. Here's a Canadian press release:

"The WTO has ruled that the Byrd Amendment does not conform with international trading obligations," said International Trade Minister Jim Peterson. "It is our view that it effectively provides a distorting double advantage to U.S. industry and, if left in place, could lead to billions of dollars in Canadian-paid duties being handed over to U.S. companies. I call upon the U.S. to preserve the integrity of the global trading system by moving expeditiously to repeal the Byrd Amendment." Under the Continued Dumping and Subsidy Offset Act of 2000, known as the Byrd Amendment, U.S. companies that support petitions for anti-dumping and countervailing duty investigations against foreign imports are able to benefit not only from the imposition of additional duties at the border, but also from the subsequent direct payout of those duties from the U.S. Treasury. Canada and 10 other WTO members successfully challenged the Byrd Amendment on the basis that it provides illegal remedies not covered in relevant WTO agreements. The key finding of the original panel was upheld by the WTO's Appellate Body, and the U.S. was given until December 27, 2003, to comply with the decision. The request for retaliatory authority comes in the wake of the failure of the U.S. Congress to move to repeal or amend the Byrd Amendment by that deadline. The request will be discussed in a special Dispute Settlement Body meeting scheduled for January 26, 2004, and may subsequently be referred to an arbitrator. Canada and co-complainants are seeking a level of retaliation linked to the dollar amount disbursed under the Byrd Amendment. If taken, retaliation measures could come in the form of tariffs or the suspension of certain obligations under the WTO Agreements on Anti-Dumping and Subsidies and Countervailing Measures, the same Agreements that the Byrd Amendment violates. Any decision to impose retaliatory measures would only be taken after the expected arbitration process at the WTO is completed and following public consultations in Canada over the next few months on various options." The economist who heads the FDA Christopher Rowland profiles Mark McClellan, the first economist to head the Food and Drug Administration (FDA), in today's Boston Globe here: "FDA's economist in chief". Smart (with a medical degree from Harvard and an economics doctorate from MIT), from a political Texas family, Deputy Assistant Treasury Secretary in the Clinton Administration, White House staff early in this administration. The article focuses much more on personal details than on his policy ideas.

"He believes in markets," said Cutler. "He has a way of thinking about the world that is economically driven, with costs and incentives and individual choice." Cutler said McClellan's initiative to increase FDA approvals of generic drugs, which offer low-cost competition for big brand-name pharmaceuticals, is evidence that he is "not in the pocket of anybody." Defending himself against charges that he is too close to the drug industry, McClellan also cited his support of generic drug approvals. "I don't think that was on the top of the list" of the drug industry lobby, he said." 1/17/2004

GAO report on Cancun trade negotiation The General Accounting Office (GAO), an arm of Congress, issued a report today on the September Cancun trade conference. That conference was a meeting of trade ministers of the member nations of the World Trade Organization (WTO). They met to provide direction to negotiators involved in the Doha round of trade negotiations. The report (GAO-04-250; January 16, 2004; 49 pages) may be found here: "Cancun Ministerial Fails to Move Global Trade Negotiations Forward; Next Steps Uncertain". (look to the lower left under "GAO Reports"). The report goes over the events leading up to Cancun, and analyses the reasons for the failure of the talks there. From the abstract:

Ministers attending the September 2003 Cancun Ministerial Conference remained sharply divided on handling key issues: agricultural reform, adding new subjects for WTO commitments, nonagricultural market access, services (such as financial and telecommunications services), and special and differential treatment for developing countries. Many participants agreed that attaining agricultural reform was essential to making progress on other issues. However, ministers disagreed on how each nation would cut tariffs and subsidies. Key countries rejected as inadequate proposed U.S. and European Union reductions in subsidies, but the U.S. and EU felt key developing nations were not contributing to reform by agreeing to open their markets. Ministers did not assuage West African nations’ concerns about disruption in world cotton markets: The United States and others saw requests for compensation as inappropriate and tied subsidy cuts to attaining longer-term agricultural reform. Unconvinced of the benefits, many developing countries resisted new subjects—particularly investment and competition (antitrust) policy. Lowering tariffs to nonagricultural goods offered promise of increasing trade for both developed and developing countries, but still divided them. Services and special treatment engendered less confrontation, but still did not progress in the absence of the compromises that were required to achieve a satisfactory balance among the WTO’s large and increasingly diverse membership. Several other factors contributed to the impasse at Cancun. Among them were a complex conference agenda; no agreed-upon starting point for the talks; a large number of participants, with shifting alliances; competing visions of the talks’ goals; and North-South tensions that made it difficult to bridge wide divergences on issues. WTO decision-making procedures proved unable to build the consensus required to attain agreement. Thus, completing the Doha Round by the January 2005 deadline is in jeopardy." 1/16/2004

Trade and productivity On Monday the Council of Foreign Relations (CFR) held a panel discussion with three former U.S. Trade Representatives (Carla Hills, Mickey Kantor, and Charlene Barshefsky). The transcript of the discussion is here: "Former U.S. Trade Representatives ". Panel moderator Louis Gerstner asked the panelists how they would advise a presidential candidate to handle the trade issue. Barshefsky came back to this question later in the discussion and said:

* As IT hardware prices have declined, the importance of IT services and software in the IT package has increased from 58 to 69 percent of IT spending in 1993 and 2001,respectively. Over the same period, growth in software and services spending at 12.5 percent overwhelmed growth in hardware spending at 6.7 percent. In the face of this demand, and enabled only since the mid-1990s by the Internet and standardization of methods, software and services are now beginning to be produced globally. Just as for IT hardware, globally integrated production of IT software and services will reduce these prices and make tailoring of business-specific packages affordable, which will promote further diffusion of IT use and transformation throughout the US economy. * When some production of software and services is done abroad, some jobs will be done abroad too. Recent efforts to quantify IT-related and other white collar job loss ?offshore? frequently use the peak of the economic and technology boom as the base for analysis,thus ignoring the business cycle, trend decline in manufacturing employment, dollar overvaluation,and technology bust. Cutting through the technology boom and peak of the business cycle and comparing end-1999 with October 2003,employment in architecture and engineering occupations is stable, that in computer and mathematical occupations is 6 percent higher and in business and financial occupations, 9 percent higher. * Going forward, broader diffusion of IT throughout the economy points to even greater demand for workers with IT skills and proficiency. In the 1990s,investment in IT propelled job growth for workers with IT skills to twice the rate of job growth in the overall economy.Over the next decade, the Bureau of Labor Statistics (BLS) projects that job growth to 2010 in occupations requiring IT skills will be more than three times the rate of job growth in the overall economy. * Globalization of software and services,enhanced IT use and transformation of activities in new sectors, and job creation are mutually dependent. Breaking the links, by limiting globalization of software and services or by restricting IT investment and transformation of activities or by having insufficient skilled workers at home, puts robust and sustainable US economic performance at risk." Jump-starting Doha Last Sunday U.S. Trade Representative Robert Zoellick tried invigorate the Doha Round of trade negotiations. I posted links to newspaper reports, here: "U.S. wants to jump start Doha Round". Zoellick sent a letter to some 150 trade ministers, the text of the letter may be found here, at the web site of the International Centre for Trade and Sustainable Development (ICTSD): "Dear Minister". The next day, Monday, the Council of Foreign Relations (CFR) held a panel discussion with three former U.S. Trade Representatives (Carla Hills, Mickey Kantor, and Charlene Barshefsky). The transcript of the discussion is here: "Former U.S. Trade Representatives ". Panel Moderator Louis V. Gerstner (former Chairman of IBM) started off asking the panelist about the prospects for reviving Doha, and "in particular what concessions the U.S. may have to make to move discussions forward." Barshefksy had the best response:

Second, developing countries have always said no bloated agenda -- no competition policy, no investment, no procurement, no trade facilitation. Particularly acute are the issues of competition policy and investment, where the developing countries since 1996 when Leon Brittan enunciated this agenda for the European Union, have been entirely consistent on this point. And only now -- so this is now eight years later -- the European Commission is finally recognized that its very, very bloated agenda does not have the support of the developing countries. Third, and I think this is most problematic, the advanced developing countries don't really want to undertake obligation. Their view is they were created in the Uruguay Round. They never got the benefit of the bargain. They never understood fully what they had agreed to. And in any event, developed countries never did what they said they were going to do. So the view of the more advanced developing countries in particular is: Now it's our turn. You open your agriculture markets. Get rid of the bloated agenda. Make, as Mickey said, some other changes. And we will go along. And the problem with that is not that they are entirely wrong. The problem is what it doesn't tell you. So, for example, India is very quick to criticize the closed U.S. market in for example textiles. But India doesn't buy from Bangladesh. So to say that the U.S. is a problem when there is no interregional trade in South Asia is a little bit disingenuous, and the result I think is that an aggressive developed country agricultural proposal, paring down the agenda, the trade for that it seems to me is on the part of the advanced developing countries to undertake obligations, the more significantly open their markets; and, in addition, advanced developing nations need to be somewhat more generous to the poorest of nations."

And let me quickly say that when we say the "developing world," there are only about 30 countries that aren't developing. This is a big problem. We have got 49 countries that the U.N. says are desperately poor. And I think any of us would agree that for them we could have a period of a transition that would give open markets, rather like the Europeans have on anything but arms. But what do you do about the advanced developing country -- the Brazils, the Indias, the growing export capacity of China? There they have to contribute. And since 70 percent of the trade of poor countries is with other poor countries, Charlene is right on. If Bangladesh and India deal themselves out, then they are not going to get the prosperity that we dream of as a result of our opening our markets. But we've got a lot to do too. Our trade picture is not a happy one from the point of view of poor countries." How to run a presidency Brad DeLong posts transcripts of comments by Dick Cheney and Don Rumsfield (both former chiefs of staff for President Ford) on how to coordinate staff and departmental efforts. Both men seem to know what's necessary so, Delong asks, what's going wrong in the current administration. The quotes are taken from Chief of Staff: Twenty-Five Years of Managing the Presidency (1988) edited by Samuel Kernell and Samuel L. Popkin. Kernell and Popkin present annotated transcripts from a 1986 meeting of eight former chiefs of staff, back to the Eisenhower administration. DeLong's post is here: "Keeping the Process Rolling". The diamond-water paradox Craig Newmark points to a version of the diamond-water paradox: "Newmark's Door". Remember the diamond-water paradox - life absolutely depends on water, nothing serious depends on diamonds; yet diamonds are extremely valuable, while water is cheap. Resolution depends on the relative abundance of the two goods, and the value we place on having just a little more or less. If you have a lot relative to your requirements then you won't value a small additional amount by very much - which is generally the case with water. While diamonds are on the table, let me draw your attention to this paper by Margaret Brinig: "Rings and Promises".

However, before the Depression, diamond rings were not considered a requisite for betrothal by most Americans... What then made women rather suddenly demand diamonds on the occasion of their engagement, so that by 1945 the typical bride wore a brilliant diamond engagement ring and a wedding ring to match in design??..." WorldWatch on the state of the world Gregg Easterbrook reviews the annual WorldWatch report, State of the World 2004, here: "EASTERBLOGG'S BOOKSHELF".

Among this year's fascinating data points is the Worldwatch estimate that the globe now has 1.7 billion people "belonging to the consumer class," living at a high material standard. That 1.7 billion well-off is more than the total number of people alive at the beginning of the twentieth century. And the largest share, 494 million, are in East Asia and the Pacific nations. The next-largest share, 349 million, reside in Europe; the United States comes in third, with 271 million members of the consumer class. Another great tidbit: "The $57 billion global trade in coffee, cocoa, wine and tobacco is worth more than the international trade in grain." Another: Eight percent of the total energy expenditure of the United States goes simply to refine petroleum. Another: Antibacterial soaps and wipes, a huge fad in the West, may actually increase disease by killing off the innocuous bacteria that keep the body's immune system on its toes..." 1/15/2004

Environmental impact of an early culture "Cronaca" points to a news story on Celtic lead pollution in France: "Polluting Celts". Lead deposits date back to 1300 B.C. Two take away points: (1) simpler, more primitive, cultures can have significant environmental impacts; (2) certain types of pollution are persistent. The research was carried out by looking at pollen counts and lead levels in different strata of local peat bogs. From the original article, which appeared in Nature:

But around 1300 BC, the first lead mine opened. In those days, lead was a valuable resource as it was used to help smelt other ores. Adding lead lowered the melting point of the metal mixture to temperatures that a charcoal furnace could reach - about 700 °C. Lead was also later used for water pipes and other vessels. The opening of the mine is marked by a sharp rise in the lead levels in the peat, along with a drop in pollen from local trees, which were probably chopped down as fuel for the smelting ovens. Lead pollution peaked in the first century BC, after a Celtic tribe settled the area to exploit the rich deposits of lead, silver and zinc in the surrounding hills, and once again in the nineteenth century at the height of the Industrial Revolution." Peer review of regulations Chris Mooney points to columns in the St. Louis Post-Dispatch ("Pathetic") and Washington Post ("Washington Post on Peer Review" on the proposed Office of Management and Budget (OMB) guidelines on peer review of science underlying regulations. Four myths about real estate markets Have you inadvertently accepted one of these four myths about the real estate market? Kash, at Angry Bear will tell you what they are: "Dispelling Myths About The Real Estate Mark". 1/14/2004

Political manipulation of science Chris Mooney discusses the political manipulation of science in this Skeptical Inquirer column on recent proposals for peer review of the science underlying regulation: "The Politics of Peer Review". Sir Humphrey Appleby describes how to discredit inconvenient scientific results in this episode of Yes, Minister: "The Greasy Pole". Here is a summary of Sir Humphrey's discreditable rules:

Stage One: The public interest 1. Hint at security considerations 2. Point out the report could be used to put unwelcome pressure on government because it might be misinterpreted 3. Say that it is better to wait for the results of a wider and more detailed survery over a longer time-scale 4. If there is no such survery being carried out, so much the better. Commission one which gives more time to play with. Stage Two: Discredit the evidence that you are not publishing, indirectly by press leaks. Say that 1. it leaves important question unanswered 2. much of the evidence is inconclusive 3. the figures are open to other interpretations 4. certain findings are contradictory 5. some of the main conclusions have been questioned Stage Three: Undermine the recommendations using anassortment of governmental phrases: 1. 'not really a basis for long term decisions...' 2. 'not sufficient information on which to base a valid assessment...' 3. 'no reason for any fundamental rethink of existing policy...' 4. 'broadly speaking, it endorses current practice...' These phrases gives comfort to people who have not read the report and who don't want change- i.e. almost everybody Stage Four: Discredit the man who produced the report, done OFF THE RECORD Explain that: 1. he is harbouring a grudge against the government 2. he is a publicity seeker 3. he's trying to get his knighthood 4. he is trying to get his chair 5. he is trying to get his Vice-Chancellorship 6. he used to be a consultant to a multinational company, or 7. he wants to be a consultant to a multinational company" Yes Minister & Yes Prime Minister!". This web site has a lot of other good bits from the show.) In the same episode, Minister for Administrative Affairs Jim Hacker, exploits the difference between individual and social risk aversion to get the results he wants from a metadioxin risk assessment. Here is a website devoted to Yes, Minister: "The Yes (Prime) Minister Files". It includes detailed summaries of all the episodes, still shots, selected dialog, and sound/video clips. Suskind's book about Treasury Secretary Paul O'Neill Amazon is racing my copy of the book to Juneau, but until it gets here I'm dependent on Brad DeLong's posts. Two good posts today. First, a transcript, with a DeLong introduction and commentary by Paul O'Neill, of a late November 2003 meeting to plan for the 2003 tax cut legislation. I assume that Ron Suskind based his account on a transcript from among the 19,000 documents O'Neill supplied him. Here: "Worst Presidential-Level Economic Policy Meeting Ever". Second, DeLong's analysis of how to prepare to be a Treasury Secretary: "Getting Robert Rubin's Job". Key steps: (1) know your conditions for taking the job, negotiate, create a contract in a memorandum of understanding, and be willing to walk away if you can't get what you need; (2) forge relationships - with agency allies, with White House staff, with your own staffers, with Congress, with the Chair of the Federal Reserve, and so on; (3) learn about the job - talk to people who've been in the Treasury, spend time with the current Secretary. The budget crisis Steve Verdon at Deinonychus antirrhopus posts on an Urban Institute report on Social Security, Medicare, and the budget deficit, here: "Budget Crisis at the Door". The post won't take you long, but have a look at the graphic. Peer review of the science behind rulemaking The federal Office of Management and Budget (OMB) has proposed guidelines for peer review of the federal science underlying rule making decisions. I posted on this in December. Link here: "Peer reivew of the science underlying regulations" and here: "Are OMB's new "peer review" proposals meant to gum up the regulatory works?" for links to the proposed guidelines in the Federal Register, a story in the Baltimore Sun and analysis by Tyler Cowen and Kevin Drum. Chris Mooney has also written on this: "A Threat from NRDC" (which has a link to a Natural Resources Defense Council critique) and "The Politics of Peer Review" (this one from the Skeptical Inquirer). Mooney also had a blog posting on December 8, but I can't make a link to it work. You can get at it through his archives. From the Skeptical Inquirer column:

...the inevitable negative peer reviews produced in this process could also bolster the legal cases of corporations engaged in never-ending litigation to block environmental or other rules. Additional peer review procedures wouldn't just consume time and money; they would also create novel opportunities for interested parties to raise challenges at various stages of the process, such as over the selection of reviewers or the composition of their reports. ...everyone agrees that peer review represents a noble goal. But such lofty objectives can be easily subverted, if you're clever or cynical enough. That's exactly what's happening with the OMB proposal: An established and well respected scientific norm is being used to actually undermine science. ...Furthermore, industry groups have already demonstrated a canny ability to exploit the existing academic peer review process to their own advantage. A telling example comes from the testimony of George Washington University epidemiologist David Michaels, a former Clinton administration Energy Department official and chief critic of OIRA's "peer review" proposal:

Foreign lobbying and U.S. welfare Foreign lobbying on trade issues may improve the welfare of U.S. citizens, argue Kishore Gawande, Pravin Krishna, and Michael J. Robbins in this National Bureau of Economic Research (NBER) working paper: "Foreign Lobbies and US Trade Policy". Here's the abstract:

1/13/2004

Robert Samuelson on outsourcing Washington Post economic columnist Robert Samuelson talks about services oursourcing in tomorrow's paper: "The Specter of Outsourcing".

The reason is that imports also create gains. Despite job losses, consumers or companies gain. Lower prices boost purchasing power or profits. That creates more demand at home. Consumers can spend more; businesses can invest more. As long as the economy responds by expanding production -- and offering new things to buy -- then most job losses, even if traumatic for individuals, are temporary. Similarly, what other countries earn abroad through exports they can also spend abroad. Their imports may not initially come from the United States, but if our products remain competitive, we'll get an adequate share of global trade..." Coordinating economic policy Brad DeLong is reading Ron Suskind's new book on Paul O'Neill and Bush Administration policy making (The Price of Loyalty: George W. Bush, the White House, and the Education of Paul O'Neill) and is sharing selections from the book. This post deals with administration policy making: "Why Oh Why Can't We Have a Better Press Corps? Part CCCXXIX" The post title is misleading. This selection deals with Lawrence Lindsey and the National Economic Council (NEC). The NEC was set up by Robert Rubin at the start of the Clinton Administration to coordinate economic policy. The point of it was to provide an honest brokerage, guaranteeing all agencies that their views would get a fair hearing by the president, and making sure that the president got a fair presentation of a wide range of viewpoints. The quotations in DeLong's post make it very clear that Bush's first Treasury Secretary, Paul O'Neill did not feel that the NEC under Lawrence Lindsey was providing him an honest brokerage service. Rubin would have worked hard to make O'Neill feel like a client, and so get him to buy into the NEC process. Lindsey worked hard to alienate, marginalize, and otherwise undercut O'Neill. That said, there is no necessary reason for the Bush Administration to choose the Clinton Administration NEC approach to making economic policy. Other administrations have used different processes. For example, Kennedy:

Stocks are not a bargain... ...argues Barry L. Ritholtz at The Big Picture: "Market Cap as a % of GDP". U.S. wants to jump start Doha Round The "Doha Round" of trade liberalization talks ground to a halt in Cancun last September. Now U.S. Trade Representative Robert Zoellick is trying to get them moving again: "U.S. Seeks Fresh Start for Stalled WTO Trade Talks". This Financial Times column by Guy de Jonquires and Frances Williams ("Cautious welcome for move to revive trade talks") provides commentary, as does this blog post by Peter Gallagher ("US suggests new efforts on Doha Round"). Both items point to a move by the U.S. away from E.U. positions, and toward a more radical position on elimination of farm subsidies. Brazil's initial reaction is positive, according to Terry Wade, of Dow Jones Newswires: "Brazil Reacts Positively To Zoellick's Move At WTO".

...The U.S. sharply criticized Brazil for obstructing Doha talks late last year in Mexico by organizing a group of 20 developing nations to demand big changes in farm policy in Europe, the U.S. and Japan. But the Latin American country may have ultimately forced Zoellick's hand by shoring up relations with China and India, which also led the bloc of developing nations. The dispute over Washington's agricultural policies also has slowed U.S. attempts to forge a Free Trade Area of the Americas spanning 34 countries." The Swiss have invited about 30 ministers to a short Doha related meeting in the course of the World Economic Summit coming up later this month in Davos: "...Mini WTO [World Trade Organization - Ben] ministerial planned on sidelines of Davos economic forum".

"Federal councilor Deiss simply wanted to benefit from the presence of the trade and economy ministers to take stock of the Doha process and to look to the future about how it may possibly move forwards," explained Manuel Sager. The so-called Doha Development Agenda has been on hold since a major meeting in Mexico last September collapsed when bickering over cross-border investment and competition added to a more fundamental row about farm subsidies in richer countries and the high tariffs on agriculture imports from developing nations..." 1/12/2004

Treasury Secretary Paul O'Neill Brad DeLong didn't think Paul O'Neill did a good job as Treasury Secretary. Here's a useful archive of his blog posts on O'Neill from that period: "Paul O'Neill". There are links to ten earlier posts in the following extract from the archive post:

Why hasn't employment bounced back? Employment levels have been slow to bounce back following the 2001 recession - they also recovered slowly from the previous recession in the 1990s. Nevertheless, unemployment has been falling. This can only be because people are opting out of the labor force. Three posts over at Angry Bear shed light on what might be going on. First, Kash looks at the data ("The Unemployment Rate Puzzle") and finds that it is (a) men, not women, who are leaving the labor force, and (b) "more poorly educated people are working, while more college educated people are dropping out of the labor force." Second, AB ("More Unemployment") Economists for Dean post arguing that the numbers of people on disability increased dramatically following a liberalization of disability program rules in the late 1980s and early 1990s. People on disability aren't treated as members of the labor force. Third, Kash again ("Follow-up to the Unemployment Rate Puzzle") links the changes to long run declines in male labor force participation (there has been an increase in men staying home with children, and a trend toward earlier retirement).

1/11/2004

Paul O'Neill speaks out The CBS News website reports on Ron Suskind's new book on administration decision: "Bush Sought ‘Way’ To Invade Iraq?". The book draws heavily on interviews with former Bush Administration Treasury Secretary Paul O'Neill (on on about 19,000 documents - including transcripts of important meetings - supplied by O'Neill). In an interview with CBS News, Suskind described a key November 2002 meeting at which decisions were made to adopt this year's tax cut:

“It's a huge meeting. You got Dick Cheney from the, you know, secure location on the video. The President is there,” says Suskind, who was given a nearly verbatim transcript by someone who attended the meeting. He says everyone expected Mr. Bush to rubber stamp the plan under discussion: a big new tax cut. But, according to Suskind, the president was perhaps having second thoughts about cutting taxes again, and was uncharacteristically engaged. “He asks, ‘Haven't we already given money to rich people? This second tax cut's gonna do it again,’” says Suskind. “He says, ‘Didn’t we already, why are we doing it again?’ Now, his advisers, they say, ‘Well Mr. President, the upper class, they're the entrepreneurs. That's the standard response.’ And the president kind of goes, ‘OK.’ That's their response. And then, he comes back to it again. ‘Well, shouldn't we be giving money to the middle, won't people be able to say, ‘You did it once, and then you did it twice, and what was it good for?’" But according to the transcript, White House political advisor Karl Rove jumped in. “Karl Rove is saying to the president, a kind of mantra. ‘Stick to principle. Stick to principle.’ He says it over and over again,” says Suskind. “Don’t waver.” In the end, the president didn't. And nine days after that meeting in which O'Neill made it clear he could not publicly support another tax cut, the vice president called and asked him to resign..." Friedrich Hayek Virginia Postrel surveys the work of economist Friedrich Hayek in today's Boston Globe: "Friedrich the Great".

...Hayek's most important insight, which he referred to as his "one discovery" in the social sciences, was to define the central economic and social problem as one of organizing dispersed knowledge. Different people have different purposes. They know different things about the world. Much important information is local and transitory, known only to the "man on the spot." Some of that knowledge is objective and quantifiable, but much is tacit and unarticulated. Often we only discover what we truly want as we actually make trade-offs between competing goods." The economic problem of society," Hayek wrote in his 1945 article, "is thus not merely a problem of how to allocate `given' resources -- if `given' is taken to mean given to a single mind which deliberately solves the problem set by these `data.' It is rather a problem of how to secure the best use of resources known to any of the members of society, for ends whose relative importance only these individuals know. Or, to put it briefly, it is a problem of the utilization of knowledge which is not given to anyone in totality." The key to a functioning economy -- or society -- is decentralized competition. In a market economy, prices act as a "system of telecommunications," coordinating information far beyond the scope of a single mind. They permit ever-evolving order to emerge from dispersed knowledge... This is Hayek's information problem. The problem can be solved through decentralized decision-making coordinated by market prices. I learned about the Globe column from Postrel's blog, "Dynamist.com". 1/9/2004

Job growth slows in December Job growth slowed in December. Louis Uchitelle has the story in Saturday's New York Times: " Growth in Jobs Came to a Halt During December ".

Most forecasters had said they thought December would be a breakthrough month for job creation, given the strengthening economy. But instead of the 150,000 new jobs they had expected, there were a minuscule 1,000. The unemployment rate dropped to 5.7 percent from 5.9 percent in November, but that was mainly because so many people chose not to look for work, a requirement to be counted as unemployed... ...there is little more the president can do to stimulate the economy, and the administration is not likely to get much more help from the Federal Reserve, which has already lowered short-term interest rates to just 1 percent. That leaves the White House waiting and hoping that the employment picture improves between now and the elections." Paul O'Neill's story We're apparently going to get former Bush Administration Treasury Secretary Paul O'Neill's insider's view of policy making in the Bush Administration. Jonathan Wiseman has the story at the Washington Post: "O'Neill Depicts a Disengaged President".

The book will be released next week and was not available yesterday. The only on-the-record details to be had were selected quotes released by CBS from the book and from an interview with O'Neill to be aired Sunday on "60 Minutes." The book is meant to be a chronicle of the first two years of the Bush administration and the process that shaped the president's policymaking, mostly seen through O'Neill's eyes. According to the CBS material, O'Neill told Suskind that Bush was so inscrutable that administration officials had to devise White House policy on "little more than hunches about what the president might think."..." What happened in Botswana? Sub-Saharan Africa is an economic basketcase. Elsa Artadi and Xavier Sala-i-Martin reviewed sub-Saharan Africa's economic growth performance in the National Bureau of Economic Research working paper, "The Economic Tragedy of the XXth Century: Growth in Africa." As summarized by Les Picker in "The Economic Decline in Africa":

P.S. January 16: Tyler Cowen beat me to Beaulier's work in this Marginal Revolution post from last October 11: "Why Botswana?". Cowen summarizes an alternative view - one that Beaulier critiques in his paper, points to Mauritius as a second success story, and provides a link to a very interesting post by Abiola Lapite on "Ethnic Homogeneity and Economic Growth in Africa." 1/8/2004

OIRA Cindy Skrzycki, regulation columnist for the Washington Post, talks about how the Office of Information and Regulatory Affairs (OIRA), a small part of the federal government's Office of Management and Budget (OMB) influences agency regulatory activity: "Tiny OIRA Still Exercises Its Real Influence Invisibly".

For almost every constituency involved in the rulemaking process, a favorite Washington game long has been guessing what OIRA did to rules -- or told agencies to do to them. The office, which has only 55 staff members, has the authority to review and suggest changes to the major regulatory proposals of more than 100 federal agencies..." Risk and resource allocation Ed Lotterman explains how our minds are biased in a way that make it hard for us to think clearly about risk may increase risk of premature death: "Real World Economics: Mad cows and irrational humans". In this entertaining column from the Twin Cities Pioneer Press Lotterman points out that we are likely to accept riskier situations if we feel there is an element of control, and we are likely to underestimate risks in familiar situations and overestimate them in unfamiliar situations. He shows how these may produce personal and public-policy responses to risk that create increased risks. Mad cow disease is unfamiliar, and we can't really feel any control in coping with the risk.

Ask health economists and epidemiologists to list the 10 best ways to reduce premature death or improve health with the same amount of resources, and I am quite sure that reducing BSE via a cow tracking system won't appear on many such lists." 1/7/2004

Endangered Species Act at 30 Lynne Kiesling, at Knowledge Problem has a useful survey of conservative blog commentary on the 30th Anniversary of the Endangered Species Act, here: "The Endangered Species Act At Age 30". 1/6/2004

The Years the Locusts are Eating The Congressional Budget Office (CBO) has a new report on "The Long-Term Budget Outlook" The report projects alternative spending and revenue scenarios out over the next 50 years. Many plausible projections, especially for Medicare and Medicaid spending are alarming. The following figure projects Medicare and Medicaid costs (as a percent of gross domestic product - GDP) out over the next 50 years, under different assumptions about excess cost growth. Excess cost growth is the rate of program cost growth per enrollee in excess of the rate of growth in per capita GDP. The figure suggests that, with an excess cost growth rate of 1%, Medicare and Medicaid expenses would grow from about 4% now to over 10% in 2050 (this is the central projection line). In recent years, the excess cost growth rate has been on the order of 1.7%. The top projection line is a 2.5% growth rate.  Figure 3-1: Total Federal Spending for Medicare and Medicaid Under Different Assumptions About Excess Cost Growth (page 28). Vertical axis shows spending as a percent of GDP. Figure shows three different scenarios. Washington Post economics columnist Robert Samuelson writes about the CBO study today: "The Boomers' Time Bomb Denial" He brings home the magnitude of the problem:

...federal spending is clearly moving toward a higher plateau. Immense tax increases would be needed to pay for this spending. In the past 30 years, federal taxes have averaged 18.4 percent of GDP, slightly higher than they are today. Raising taxes from this level to, say, 24 percent of GDP involves an increase of almost a third, amounting to $600 billion a year in today's dollars...If spending -- on the elderly or everything else -- isn't cut or taxes raised, deficits will spin out of control."

Little was done. Political leaders of the "greatest generation" ignored the future, and now their baby-boomer successors -- led by presidents Clinton and Bush -- are doing the same. But not all blame belongs with leaders. In a new book, "Who Will Pay?" economist Peter Heller of the International Monetary Fund observes that average citizens have been enablers of the politics of denial. No less than their leaders, they're shortsighted, he argues. Or perhaps just selfish."

Conventional analyses of sustained budget deficits demonstrate the negative effects of deficits on long-term economic growth. Under the conventional view, ongoing budget deficits decrease national saving, which reduces domestic investment and increases borrowing from abroad. Interest rates play a key role in how the economy adjusts. The reduction in national saving raises domestic interest rates, which dampens investment and attracts capital from abroad. The external borrowing that helps to finance the budget deficit is reflected in a larger current account deficit, creating a linkage between the budget deficit and the current account deficit. The reduction in domestic investment (which lowers productivity growth) and the increase in the current account deficit (which requires that more of the returns from the domestic capital stock accrue to foreigners) both reduce future national income, with the loss in income steadily growing over time. Under the conventional view, the costs imposed by sustained deficits tend to build gradually over time, rather than occurring suddenly. The adverse consequences of sustained large budget deficits may well be far larger and occur more suddenly than traditional analysis suggests, however. Substantial deficits projected far into the future can cause a fundamental shift in market expectations and a related loss of confidence both at home and abroad. The unfavorable dynamic effects that could ensue are largely if not entirely excluded from the conventional analysis of budget deficits. This omission is understandable and appropriate in the context of deficits that are small and temporary; it is increasingly untenable, however, in an environment with deficits that are large and permanent. Substantial ongoing deficits may severely and adversely affect expectations and confidence, which in turn can generate a self-reinforcing negative cycle among the underlying fiscal deficit, financial markets, and the real economy:..."

All of this is conventional stuff... What's new is what Mr. Rubin and his co-authors say about the consequences. Rather than focusing on the gradual harm inflicted by deficits, they highlight the potential for catastrophe. "Substantial ongoing deficits," they warn, "may severely and adversely affect expectations and confidence, which in turn can generate a self-reinforcing negative cycle among the underlying fiscal deficit, financial markets, and the real economy. . . . The potential costs and fallout from such fiscal and financial disarray provide perhaps the strongest motivation for avoiding substantial, ongoing budget deficits." In other words, do cry for us, Argentina: we may be heading down the same road."..." Gift-giving I've probably overdone the Marginal Revolution links tonight, but let me draw your attention to one more, Tyler Cowen's "Facts about gift-giving". Violence and business in Russia Fabio Rojas, at Marginal Revolution points to a recent New York Review of Books article by Robert Cottrell ("Violence and Economy Building"). Cottrell reviews three books on the ongoing Russian transition: "Putin's Trap". The book that attracted Rojas' attention was Violent Entrepreneurs: The Use of Force in the Making of Russian Capitalism by sociologist Vadim Volkov. Volkov describes the evolution of organized criminal violence in Russia (and its interaction with business) from the early nineties, basing his account on interviews with gang members. Cottrell describes the evolution this way:

A businessman who pays tribute even once to a gang is considered the property of that gang and he is taxed forever after. But still, since the businessmen become, in effect, the property of a gang and a source of income, they need to be protected against other gangs, and even assisted in making more money. The bandits are drawn into providing the businessmen with information on competitors, collecting debts, and helping with other practical problems including relations with officials. In the terminology of the economist Mancur Olson, they become "stationary bandits," with an interest in the continuing welfare of their victims, and not "roving" ones, who take everything. Crucially, the gangs, because they understand and in some sense respect one another, evolve into guarantors of the transactions into which "their" businessmen enter. This practice becomes the rule, Volkov finds, to the point that, throughout the Russian economy, the majority of high-value business agreements could only be concluded on the condition that enforcement partners, be they criminal groups or legal security services, participate and provide mutual guarantees. The mere absence of a recognized enforcement partner on one side could spoil the prospective deal... ...But violence backing up the promises had to be real, and used from time to time. After a while, a principle of mutual deterrence gradually prevailed, and the peak of business-related killings in Russia was passed in 1995. By this time, too, new players were entering the market for protection, particularly the thousands of officers driven out of Russia's security services and elite army units by the collapse in morale and lack of pay. They were joining or creating private security agencies offering more sophisticated services to businesses, and they maintained strong if informal links to the government. For a price, they could drive away the bandits infesting a company and substitute their own, more legitimate, protection. Such activities...led to a significant decriminalizing of Russian business in the late 1990s. As the criminal groups lost ground to the newer and less threatening private security companies, they adapted. Some tried to imitate the private security companies by reorganizing their operations and keeping them under tighter control. Others, such as the Tambov criminal group in St. Petersburg, diversified or changed course entirely, making investments and running businesses of their own..." What's the best size for a country? Alberto Alesina and Enrico Spolaore explore the question in a new book, The Size of Nations. Big countries enjoy lower average costs for producing public goods and raising revenues; smaller countries enjoy the benefits of more homogeneous populations. Tyler Cowen, over at Marginal Revolution, abstracts key bits from a recent Economist article on Alesina and Spolaore's work, links to a variety of resources (including working papers by both authors, and the Economist article), and provides commentary. Here: "Is it better to be a small nation?" 1/5/2004

President Coolidge's depression Jack Beatty, in The Atlantic Online, reviews a new book about Calvin Coolidge which argues that, following the death of his son in 1924, he was subject to major depression to such an extent that he "...ceased to function as President..." through 1928: "President Coolidge's Burden".

"Cooperation, makes it happen..." In 1998, sugar producers (sugar cane and sugar beet) earned an estimated $1 billion from restrictions on sugar imports that cost sugar consumers $1.9 billion ("Trade protection can cost jobs"). How could a few thousand domestic sugar producers create this transfer from, and these costs for, almost 300 million consumers? Edward Lotterman basically says "because they had help" in yesterday's column in the Twin Cities Pioneer Press: "Real world economics".

High fructose corn sweetener is very competitive with sugar when prices are high but would rapidly lose market share if lower-cost sugar could be imported freely. HAFIZ is a "related good" to sugar. Sugar price increases "shift" demand for corn sweetener in the direction of higher sales. The sugar lobby is a smaller factor in keeping out world sugar than the corn lobby..." 1/4/2004

India is coming on strong Josh Marshall, at Talking Points Memo posts on some recent remarks by Peter Drucker on the emergence of India as an economic power (Drucker's remarks are quoted from a Fortune interview): "Marshall's post on Drucker's remarks". Drucker contrasts Indian strengths with Chinese weaknesses. The message is that China is important, but India is also. Marshall reflects briefly on the political significance of this for the U.S. What will the numbers in the President's budget mean? Mark Schmitt at The Decembrist with a useful guide to media coverage of the President's budget: "How to Read the Bush Budget":

From today's Times story, (Bush's Budget for 2005 Seeks to Rein In Domestic Costs), it's obvious that the topline story the administration wants to put out is just that: reining in domestic spending..." Shrimp anti-dumping petition Paul Kedrosky at Infectious Greed links to a Washington Post story on an anti-dumping petition submitted by U.S. shrimp producers this week. According to Griff Witte in the Post:

The Southern Shrimp Alliance filed the request for tariffs on $2.4 billion worth of imports with the Commerce Department and the U.S. International Trade Commission. In its petition, the alliance said Thailand, Vietnam, India, Ecuador, China and Brazil have ravaged the domestic shrimp industry by exporting the tiny crustaceans to America at artificially low prices..." Just a few words on what is entailed in a dumping inquiry (abstracting from Douglas Irwin's new book, Free Trade Under Fire): "Dumping" occurs when foreign exporters charge a lower price in the U.S. market than in their own domestic market. This could, but often doesn't, have anything to do with using predatory pricing to take over a market. Perfectly legitimate business activities often involve charging different prices in different markets. The process starts when a domestic industry files petitions with the Commerce Department (Commerce) and with the International Trade Commission (ITC). Commerce determines if dumping is taking place and calculates the "dumping margin" or the difference between the price the foreign firms should be charging - and the price they actually charge. The ITC must determine if the U.S. industry has been materially injured. Commerce acts as an advocate for the domestic industry bringing the petition; the ITC is a quaindependentent commission, so it can be more disinterested. Commerce rarely finds that dumping has not taken place - it found dumping in 93% of cases from 1980 to 1992. The ITC found material injury two-thirds of the time over the same period. Commerce can use various ways to determine what the foreign product should be sold for. It could use the price in the home country, the price the foreign industry charges in a third country, or it could construct its own estimate of the appropriate price in the U.S. based on estimates of costs and an appropriate profit margin. To determine whether the actual price in the U.S. is high or low, Commerce can compare an average of foreign product home prices to prices on individual sales in the U.S. "If any individual U.S. price is below the average home market price, which must be the case if there is any movement in the prices over time, them dumping is found to occur. Instances in which the U.S. price exceeds the foreign price are ignored." "Material injury" is defined as "harm which is not inconsequential, immaterial, or unimportant." Only harm to industries competing with the imports are considered. Benefits to firms importing raw materials, and benefits to consumers (from lower prices and greater consumption) - are not considered. Anti-dumping tariffs will reduce imports and increase prices for the goods in question. Often imports from countries that are unaffected, increase to fill the gap. Oddly, imports may be reduced, even if the ITC finds no injury. If Commerce finds that dumping has occurred, importer liability for dumping duties begins when "Commerce issues its preliminary determination." To minimize exposure, importers may stop doing business with suppliers identified in the petition. So it isn't necessary for the ITC to find material harm in order to constrain imports. Irwin also refers to an investigation effect: imports tend to fall and prices tend to rise even before a preliminary investigation by Commerce. Source: Free Trade, Under Fire by Douglas Irwin (Princeton University Press, 2002), pages 113-121). 1/2/2004