Ben Muse |

|

|

Economics and Alaska To leave a comment click on the word "comment" at the end of each post. Click here for Atom feed Juneau webcams

Alaska/Yukon photos

Race for World Bank PresidentThe Fight for Free Trade

Economics blogs

Australian economics bloggingCanadian economics bloggingUK economics bloggingViennese economics bloggingSports economics blogsTax blogsOther blogs

Economic Columnists

Journals OnlinePolicy Essays and Papers

Archives

Where are visitors to this page? (Auto-update daily since 12-27-04) |

3/31/2004

"Time is money" Craig Newmark links to evidence that people who make more speed more. Many of the speeders interviewed report that "time is money." Bad law in Virginia Kevin Brancato (Truck and Barter) posts on Virginia's anti-"price gouging" law. Apparently the law reads (in part),

I posted on post-Isabel price-gouging last September (linking to some other useful resources): "The pros and cons of price gouging". Offshore outsourcing has little effect on U.S. jobs? Kash, at Angry Bear summarizes, and links to, an Institute for International Economics report that finds little offshore outsourcing impact on the U.S. job market: "In general, the report does not turn up any evidence the offshore outsourcing is responsible for significant job losses in any particular industry or occupation." Unfounded fear of competition Tyler Cowen reports on how and why French auction firms survived the relaxation of barriers to international competition, and the entry of Christie's and Southeby's into the market. The "small state" advantage in Congress Brian Knight reports on the existence, sources, and efficiency implications of the small state advantage in Congress in a new National Bureau of Economic Research (NBER) working paper. From the abstract:

This paper provides new evidence on the role of this small state bargaining power in the distribution of federal funds using data on projects earmarked in appropriations bills between 1995 and 2003. Relative to earmarks secured in House appropriations bills, Senate earmarks exhibit a small state advantage that is both economically and statistically significant. The paper also examines two theoretically-motivated channels through which this small state advantage operates: increased proposal power through appropriations committee representation and the lower cost of securing votes due to smaller federal tax shares. Taken together, these two channels explain over 80 percent of the measured small state bias. Finally, a welfare analysis demonstrates the inefficiency of the measured small state bias." 3/28/2004

International trade and externalities Michael Margolis and Jason Shogren point out ("How Trade Politics Affect Invasive Species Control", Resources for the Future discussion paper 04-07) that international trade itself may be a source of negative externalities. Unpleasant invasive species (think zebra muscles in the Great Lakes) may come in the cargo, or in ship ballast water; the movement of cargo may create pollution externalities; trade activity may provide opportunities for the movement of contraband or terrorists. From the abstract:

3/27/2004

While Suharto was stealing all his money, Indonesia was growing lickety-split I posted Transparency International's list of top kleptocrats below. Suharto of Indonesia leads the list, allegedly stealing something between $15 and $35 billion. But I also note that Indonesia grew quite a bit under his regime. Indonesia was one of four ASEAN countries that doubled real income per person between 1980 and 1995. (Michael Sarel, Growth and Productivity in ASEAN countries, IMF working paper, 1997). I'm not familiar with the details of the Indonesia economy during this period, but I wonder if Suharto is an example of one of Mancur Olson's predatory, rent maximizing, 'warlords' ("Creating the wealth of nations") adopting policies that increase the wealth of the nation, in order to increase his take. It's more lucrative to steal from the rich than from the poor. Tyler Cowen buckles on his armor and sallies forth to UNESCO Cowen appears to be heading over to France for a meeting on cultural diversity. Core Kerry economic team Louis Uchitelle reports on the key members of Kerry's economic team in tomorrow's New York Times:A Kerry Team, a Clinton Touch.

Remember Roger C. Altman, the high-ranking Treasury official in the early Clinton years, forced out for being too loyal to his boss in the Whitewater investigation? He is one of them. Gene Sperling, a White House insider in all eight Clinton years, is another. Then there are two less-known 30-somethings: Jason Furman, a Harvard-trained economist... and Sarah Bianchi, who was Al Gore's policy adviser in 2000 and is now Mr. Kerry's. Both got their start in the Clinton White House, as young aides barely out of college... ...Even so, the fixes that Mr. Kerry and his core economic advisers are beginning to offer are clearly rooted in Clinton economics, which is resolutely centrist. Fiscal responsibility and deficit reduction, hallmarks of the Clinton years, are bedrock orthodoxy in the Kerry camp, too. So is faith in the private sector's powers to generate prosperity. Job creation will come from corporate America, not government, once the right incentives and subsidies are in place, the war room says. In fact, the Clinton-era god of deficit reduction and private-sector supremacy is also worshiped in the Kerry camp...." 3/26/2004

Late 20th Century Kleptocrats Transparency International reports on the top ten kleptocrats of the late 20th Century:

2. Ferdinand Marcos President of the Philippines from 1972-86 US$ 5 to 10 billion 3. Mobutu Sese Seko President of Zaire from 1965-97 US$ 5 billion 4. Sani Abacha President of Nigeria from 1993-98 US$ 2 to 5 billion 5. Slobodan Milosevic President of Serbia/Yugoslavia from 1989-2000 US$ 1 billion 6. Jean-Claude Duvalier President of Haiti from 1971-86 US$300 to 800 million 7. Alberto Fujimori President of Peru from 1990-2000 US$ 600 million 8. Pavlo Lazarenko Prime Minister of Ukraine from 1996-97 US$ 114 to 200 million 9. Arnoldo Alemán President of Nicaragua from 1997-2002 US$ 100 million 10. Joseph Estrada President of the Philippines from 1998-2001 US$ 78 to 80 million" Publicly financed stadiums: no net gain Russell Roberts (at Marginal Revolution) reports on research showing that publicly financed sports stadiums don't tend to produce net economic benefits for the communities that attract them. 3/24/2004

Medicare and Social Security Reports released The trustees of the Social Security and Medicare programs issued their annual reports yesterday. Robert Pear of the New York Times says these show that the fiscal status of the Medicare program has gotten worse over the past year, but that there has been little change in the status of the Social Security program:

In its annual report to Congress, the Medicare board of trustees said the program's hospital insurance trust fund could run out of money before the end of the next decade. The trustees have made such projections in the past, but this one was much bleaker than the outlook reported just last year. By contrast, the financial outlook for Social Security, though shaky in the long run, changed little from last year..." 3/23/2004

Pollination and public policy Andrew David Chamberlain's post, "Of honey bees and apple orchards" surveys the role of honey bees in the history of economic thought with links to papers on pollination markets and the U.S. honey program. I recommend a stop by Chamberlain's blog, The Idea Shop. It's well written, with lots of original content and enticing links. These posts are little jewels; as compositions, they'll repay study by other bloggers. What can you tell about a state by the assets it exempts from bankruptcy proceedings? Scheherazade reads the character of a state in the assets it exempts from bankruptcy proceedings. What are we good at? Will the U.S. be able to compete in a world without trade barriers? Marc Andreessen, developer of the web browsers Mosaic and Netscape, surveys our strengths for John Robb. I learned about this from Alex Tabarrok at Marginal Revolution who also provides a link to a USA Today column on Andreessen's views. 3/22/2004

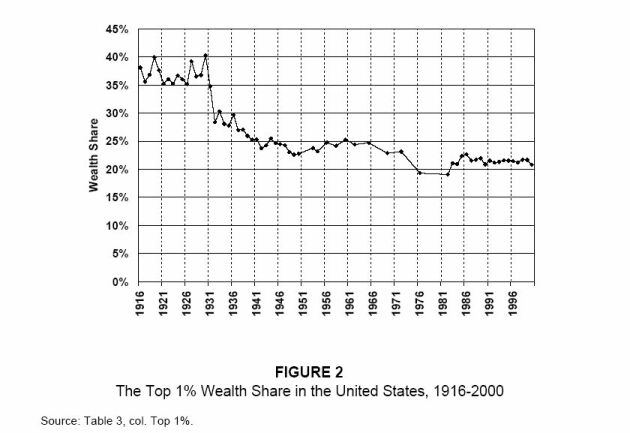

Being rich isn't what it once was The share of U.S. wealth in the hands of the top 1% of U.S. persons fell a lot in the twentieth century. Take a look at the trend, as estimated in a new working paper by Wojciech Kopczuk and Emmanuel Saez ("Top Wealth Shares in the United States, 1916-2000: Evidence from Estate Tax Returns")  Figure 2 in Kopczuk and Saez. The share ranges between 35% and 40% from 1916 to the start of the depression, then falls through the depression years and the world war. After the war, it never rises above 25%, and even appears to fall somewhat during the 1970s. It is stable at about 21-22% during the boom of the 1990s. What caused these shifts? Kopczuk and Saez have some ideas:

3/21/2004

Sending wine across state lines The constitutional amendment repealing prohibition (the 21st) included a section (Section 2) allowing states to regulate shipments of alcoholic drinks across their borders: "The transportation or importation into any state, territory, or possession of the United States for delivery or use therein of intoxicating liquors, in violation of the laws thereof, is hereby prohibited." On the other hand the Constitution's Commerce Clause, "The Congress shall have Power...To regulate Commerce with foreign Nations, and among the several States, and with the Indian Tribes...", gives Congress the power to regulate commerce between states. The tension between the two provisions is currently being addressed by the courts. On March 7, I posted on a federal court case overturning Michigan regulations forbidding direct alcohol shipments from out of state, but not in-state, wineries. The post built on another by Jim Leitzel at Vice Squad. Also see Peter Gallagher's comment to my post, with an Australian's perspective on the apparent protectionist intent of many state regulations. Stephen Bainbridge, a wine lover, has also been posting (at his blog ProfessorBainbridge), on this. On January 16, he posted with a brief mention of the issue, and a link to a Wine Institute website with legal background (and a state by state survey of restrictive laws and regulations). On January 17, he posted a response to his earlier post by reader Matthew Patterson. Petterson provides helpful background on the legal history of the 21st Amendment's Section 2. Petterson also argues that the way to free up interstate trade in wines is not to use the commerce clause to undercut the "plain meaning" of Section 2, but to work on getting states to change their laws. Today (March 21) Bainbridge points to several on-line Wine Spectator columns on the legal status of the various cases. The de-industrialization that wasn't Brink Lindsey takes on the job loss rationale for protection in a new Cato Institute briefing paper, "Job Losses and Trade. A Reality Check.". Is the U.S. de-industrializing?

Exactly the same phenomenon has played out over a longer time period with respect to agriculture. In 1870, 47.6 percent of total U.S. employment was in agriculture; by 2002, the figure had fallen to 1.7 percent. In the future, manufacturing will in all likelihood continue down the path followed by agriculture: as strong productivity growth reduces the price of manufactured goods relative to services, manufacturing’s share of the overall economy will continue to fall. People who bemoan this prospect don’t recognize economic progress when they see it. International trade has had only a modest effect on manufacturing’s declining share of the U.S. economy. It is true that imports displace some domestic production; on the other hand, exports boost sales for U.S. manufacturers. Since the United States now runs a trade deficit in manufactured goods, the net effect of trade at present is to reduce the size of the manufacturing sector. Over time, however, the effect of the trade balance on manufacturing’s share of GDP has not been large. As mentioned above, manufacturing’s share of GDP declined from 27.0 percent to 13.9 percent between 1960 and 2002; if trade had been in balance throughout that period, the estimated decline would have been from 26.5 percent to 16.0 percent. The basic picture thus remains the same even when the effects of trade are eliminated: a steady, relentless drop in manufacturing’s share of economic activity." 3/20/2004

Wheels on luggage New ideas come hard. An anecdote from Robert Shiller's new book, The New Financial Order, brings this home:

[from a footnote - Ben] Sadow managed to talk to a vice president at Macy's, who agreed in the early 1970s to start selling the luggage. The suitcases did indeed sell, and set off a major trend, even though Sadow's initial model, with fur tiny wheels, was unstable. If one walked fast while pulling it, the suitcase wobbled from side to side and sometimes developed a rocking cycle with increasing amplitude unilt the suitcase fell over sideways. Since the suitcase in its normal upright resting position tended to be low relative to one's hand, the handstrap had to be fairly long, and because it was flexible, did not allow any control of side-to-side wobble. One tried walking in a bent-over position to keep one's hand closer to the suitcase for better control, which was uncomfortable and still mostly unsuccessful in controlling the wobble. [end footnote] Sadaw's suitcases were a big improvement over suitcases without wheels, but they tended to wobble and fall over when pulled. The next great advance did not come until nearly twenty years later when a Northwest Airlines pilot, Robert Plath, invented a suitcase with two wheels widely spaced, so that the suitcase rolls along sideways with a wide axel between the two wheels. This, combined with a rigid retractable pulling handle finally yielded a stable, easily pulled suitcase that can also be used as a platform for other articles. He called it the "Rollaboard." 19th Century Aleut whaling I've been working on a project connected with Aleutian fisheries recently, so I've been thinking about the Aleutians a lot at work. The Aleutians are pretty barren. There are no trees and no wood for construction. The weather is brutal. But the Aleuts, the Unangan, thrived there for thousands of years. Marine resources, including whales, were very important to them. The native craft was the kayak - but how do you hunt whales from kayaks?  This is taken from the cover of the Aleut Corporation's 2003 Annual Report. This is a colorized version of an original 1883 drawing by Henry W. Elliott, a U.S. Treasury officer and a conservationist, who spent a lot of time out there in the late 19th Century. Elliott described the hunt:

In the months of June and July the whales begin to make their first inshore visits to the Aleutian bays, where they follow up schools of herring and shoals of Amphipoda, or sea-fleas, upon which they love to feed. The bays of Akootan and Akoon were and are always resorted to more freely by those cetaceans than are any others in Alaska, and here the hunt is continued as late as August. When a calm, clear day occurs the natives ascend the bluffs and locate a school of whales; then the best men launch their skin-canoes, or bidarkas, and start for the fields. "Two-holed" bidarkas only are used. The hunter himself sits forward with nothing but whale-spear in his grasp; his companion, in the after hatch, swiftly urges the light boat over the water in obedience to his order. Carefully looking the whales over, the hunter finally recognizes that yearling, or the calf, which he wishes to strike; for it is not his desire to attack an old bull or angry cow-whale. He calculates to a nice range where the whale will rise again from its last point of disappearance, and directs the course of the bidarka accordingly. If he is fortunate he will be within ten or twenty feet of the calf or yearling, and as it rounds its glistening back slowly and lazily out from its cover of the wavelets the Aleut throws his spear with all his physical power, so as to bury the head of it just under the stubby dorsal fin of that marine monster; the wooden shaft is at once detached, but the contortions of the stricken whale only assist to drive and urge the barbed slate-point deeper and deeper into its vitals. Meanwhile the canoe is paddled away as alertly as possible, before the plunging flukes of the tortured animal can destroy it or drown its human occupants."

Elliott figures in U.S. environmental history. The website AskArt. com provides a short biography from which the following is extracted:

He was sent north again in 1872 as U.S. Treasury Agent supervising the Alaska Commercial Company's management of the fur seal industry in the Pribilof Islands. He visited Alaska regularly thereafter, spending much of the rest of his life fighting in Congress to reverse the practices that had led to disastrous declines in the northern fur seal population." The Aleut Corporation annual report has several additional pages focusing the Akutan whaling station and Aleut involvement in commercial whaling in the early 20th Century. Minor revision on 3-22-04 3/18/2004

It's not fair! Some people have so much! Not only has he been given a gift for poetry, but Rumsfeld also has a talent for martial arts. Thanks to AB for the reference. 3/16/2004

Light blogging in the short run A lot of real work right now - blogging will probably be light for a few days. 3/14/2004

Viennese origins of the American mall Tyler Cowen has a post on Victor Gruen. Gruen, a refugee from Hitler in 1938, designed the first American shopping mall in the early 1950s. 3/13/2004

A good man, badly handled Nebraska businessman Tony Raimondo was slated for a Department of Commerce position to help U.S. manufacturing, until it became known that he had opened a factory in China. The resulting controversy led Raimondo to withdraw. But according to the Omaha World-Herald, the Chinese factory was serving the Chinese market and Nebraskans think it created 100 Nebraskan jobs. Geitner Simmons has the story. It's surprising the administration didn't see the way this story could go. Today's Washington Post has a story on problems the administration is facing in coordinating it's economic "message": "Missteps on Economy Worry Bush Supporters".

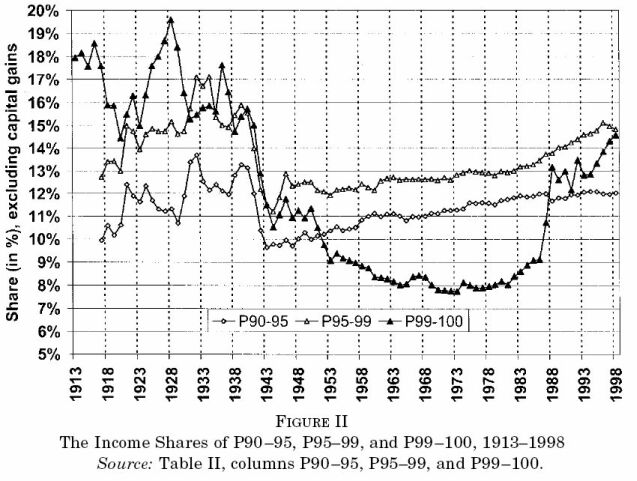

In recent weeks, the White House has had to endure its chief economist's positive comments about job "outsourcing," or sending work overseas; controversial passages in the annual Economic Report of the President; questions over the legitimacy of Bush's 2005 budget; a California swing in which Bush bragged about the possible addition of two or three jobs to a 14-person business in Bakersfield and a flap over a job-creation forecast that not even the president could stand by... But the non-naming of Anthony F. Raimondo on Thursday as assistant commerce secretary for manufacturing and services has brought the concerns to a boil. The long-anticipated announcement of a manufacturing czar was supposed to be a good-news day for a White House struggling with its economic message. Instead the planned, smiling photo op fizzled when it came to light that a year ago Bush's choice had opened a major plant in Beijing..." Trends in U.S. income distribution Thursday I posted a figure from an NBER working paper by Thomas Piketty and Emmanuel Saez showing the trend in the proportion of U.S. income earned by the top 10% of income earners. You can get a copy of the figure, and the paper it's a part of, at Emmanuel Saez's webpage. The figure was striking. In 1917, the top 10% of "tax units" had about 40% of national income. The percent of the income earned by this group rose until about 1929, ranged from about 44% to about 46% until 1940, then plummeted to the area of 32% during the war, and sat there until about 1972. From 1972 to 1998, the share of income received by this group rose almost continuously, ending the period in the area of 42%. Just for reference, the average income threshold for entry into the top 10% was about $81,000 in 1998. Here's another figure from a Quarterly Journal of Economics paper based on the NBER working paper. Where the figure on Thursday simply showed the trend for the top decile, this figure breaks the top decile down into the top percentile, the 95 to 99th percentiles, and the 90 to 94th percentiles:  Figure 2 on page 12 of Piketty and Saez, "Income Inequality in the United States, 1913-1998." QJE 118(1):1-39. This figure is also striking. Look at the radically different patterns followed by the top percentile and the groups in percentiles 90 to 99. Percentiles 90-99 appear to rise gradually from 1917 to 1940, do the 1940 WWII drop, then, following the war, begin a long sustained increase through 1998. But the top percentile is all over the place. The authors had enough data to start this series up in 1913, before the start of WWI. It plummets on U.S. entry into the war and during a post-war depression, rises through the boom of the 1920s, peaking in 1929, plummets with the onset of the Great Depression, and again with the onset of WWII, then continues to fall following the war, bottoming out about 1972, and then rising over the period 1972-1998. A large part of this last rise takes place in 1987 and 1988, following the Tax Reform Act of 1986, the authors point out. What's going on with this top percentile income share? Why do the top percentile and the remaining percentiles in the top 10% move so differently? Piketty and Saez:

3/12/2004

An economist at play Lynne Kiesling hikes through Derbyshire and visits the "birthplace of modern economic activity." World income distribution Kash, at Angry Bear, reports that the Economist has a survey article on Global Income Inequality. Kash provides key extracts. 3/11/2004

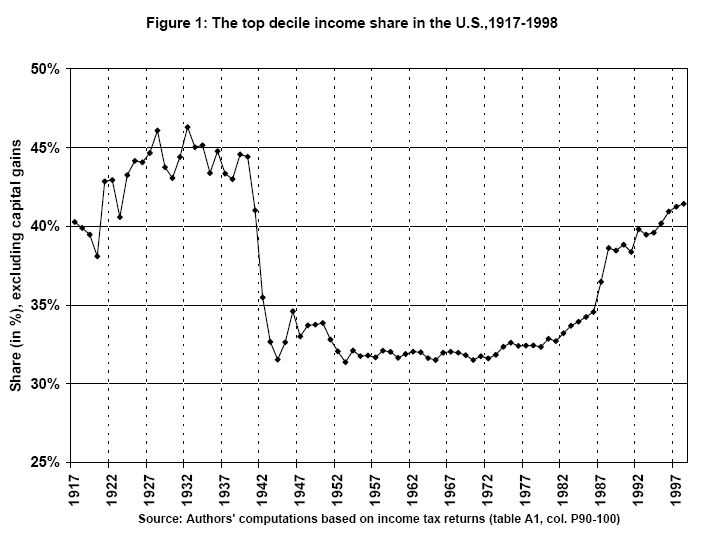

Changing income distribution in the U.S. The following figure shows estimates of the top decile income share (excluding capital gains) in the U.S. from 1917 to 1998.  The figure is from "Income Inequality in the United States, 1913-1998," a National Bureau of Economic Research (NBER) working paper by Thomas Piketty and Emmanuel Saez (NBER No 8467, September 2001). There's lots of interesting stuff in this figure - the increase in the top income share from 1917 to 1929, the plateau from 1929 to 1941, the collapse during the World War, the stable, modest percentage from 1945 to 1972, then the relentless increase, through Democratic and Republican administrations alike, from 1972 to 1998. There's a lot more in the paper - changes in distibution by fractile within the top decile, information on changes in wage and capital income shares, and comparison of top U.S. decile share trends with those in other countries. The paper is available for $5 from the NBER. (P.S. 3-13-04 This work was published in the February 2003 Quarterly Journal of Economics as "Income Inequality in the United States." You may download the entire QJE paper here.) Here's the NBER abstract:

Top income and wages shares display a U-shaped pattern over the century. Our series suggest that the 'technical change' view of inequality dynamics cannot fully account for the observed facts. The large shocks that capital owners experienced during the Great Depression and World War II seem to have had a permanent effect: top capital incomes are still lower in the late 1990s than before World War I. A plausible explanation is that steep progressive taxation, by reducing drastically the rate of wealth accumulation at the top of the distribution, has prevented large fortunes to recover fully yet from these shocks. The evidence on wage inequality shows that top wage shares were flat before WWII and dropped precipitously during the war. Top wage shares have started recovering from this shock since the 1960s-1970s and are now higher than before WWII. We emphasize the role of social norms as a potential explanation for the pattern of wage shares. All the tables and figures have been updated to the year 2000, the are available in excel format in the data appendix of the paper." Regions of Mind I had understood that Geitner Simmons was going to reform, restrict his blogging to Tuesdays, and get on with his book. I'm glad he failed - although I regret the likely delay in the book. At any rate his failure is our gain. Here are three recent and worthwhile posts, each extremely moving in their different ways: "Fallen Soldier", "Jack Johnson and Jim Crow radicalism", and "'The Passion'; brutality in popular culture ". I learn a lot about the history of my country and human nature (and how to pull together a good blog post) from frequent visits. 3/10/2004

Pirate attacks up The Progressive Policy Institute (PPI) reports that pirate attacks are up "...annual reports published by IMO [International Maritime Organization - Ben] show that pirate attacks averaged about 100 a year in the early 1990s, and now routinely exceed 400." Why? There's more ship traffic moving more cargo than before, "but economic and political issues -- notably the aftershocks of the Asian financial crisis and the collapse of Somalia -- seem to be playing roles too." A quarter of all attacks take place in heavily traveled and vulnerable Indonesian waters, where, "...stresses since the financial crisis, meanwhile, have cut Indonesia's navy budget by about two-thirds..." "Somali waters may be the world's least-policed and most dangerous. The IMO has a permanent warning to shipmasters to avoid the area altogether if possible, and especially not to anchor within 50 miles of the coast..." 3/9/2004

New blog: Blame India Watch Brad DeLong points to the new blog, Blame India Watch

King Island Christmas continued Last December I posted a short item on the book and musical, King Island Christmas. King Island Christmas is a children's book about events in the Alaskan Inupiat Eskimo community of King Island in the 1950s. Although the village site on King Island was abandoned many years ago, the King Islanders are still a distinct community in Nome, Alaska. At least some of them aren't thrilled by the book and musical. Beth Marino wrote about their concerns in The Nome Nugget in November, 2002:

The King Island Native Community asked for support from the Alaska Federation of Native delegates this year, as the Islanders prepare their case against the theft of intellectual and cultural property rights. The resolution passed by AFN to protect cultural rights came into being because of an unsanctioned theatre company that has found success peddling a play called King Island Christmas. According to the King Island Community, the tribe was neither consulted on the play nor received recognition or compensation in any manner and they are busy wondering what, if anything, they can do to reclaim their ownership of culture..." The story and letter are 18 months old. The story indicates that the King Islanders were thinking about pursuing legal remedies, but I'm not sure about the current status of those efforts. I'd been a little perplexed by the story. What would a copyright on a culture mean? Presumably it would provide a community - (how to define it and its cultural inheritance?) - with control over how cultural motifs are used and with a right to the income from their use. It wouldn't serve the purpose of encouraging creative activity since it would be protecting creation that had taken place in the past. It would stifle creative activity by increasing the costs of using materials from different cultures to create new things. Tyler Cowen at Marginal Revolution reports today on other parties interested in cultural copyrights.

We all know that U.S. copyright typically protects the expression of an idea, and not the idea itself. But hey, native tales and folklore are expressions of sorts, just not durable ones in the way we are accustomed to protecting. I don't see any principle in the pure theory of copyright itself that should rule out such an extension..." P.S. 3-11-04 Tyler Cowen has a follow-up post laying out more of the pros and cons of copywriting folklore. Let me draw your attention to two other items as well. The online version of Indian Country carries a story on "Sovereignty and Intellectual Property Rights by Rebecca L. Adamson. The World Intellectual Property Organization has a web page at its site on "Intellectual Property and Genetic Resources, Traditional Knowledge, and Folklore". P.P.S. 3-13-04 On January 20, MSNBC carried a story on the upcoming anthropological field work on old King Island. "If you set out to take Vienna, then take Vienna." (N. Bonaparte) And if you set out to record Dylan Thomas, then record Dylan Thomas! The National Public Radio (NPR) web site carries this Renee Montagne story (a couple of years old) about the young entrepreneurs who founded Caedmon Records. A lesson in focus, initiative and enthusiasm. As a bonus you get to listen to Thomas reciting excerpts from A Child's Christmas in Wales and Do Not Go Gentle Into That Good Night. Bhagwati on globalization Noted trade economist Jagdish Bhagwati asks "What Enriches The Poor And Liberates The Oppressed?"in this March 5 column from The Times of London, and answers, "globalization."

...If globalisation brings parents increased wealth, are they more likely to send their children out to work or less so because they do not need children to work and can send them to school instead? If the former is the case, then clearly policies that inhibit globalisation seem sensible. But if the latter is more likely - and numerous studies show that the rise in incomes resulting from the increased exports that accompany trade liberalisation has resulted in peasants stopping their children working and sending them to school - then we should ask: what can we do to accelerate the pace at which child labour will be reduced by globalisation?... ...A sophisticated 20-year study of recent US experience by two female economists, Elizabeth Brainerd and Sandra Black, found that, because internationally tradeable industries were in fierce competition, firms could not afford to pay men more than equally able women. Prejudice was simply unaffordable. And because they ended up hiring fewer men and more women, so raising the average wages for women and lowering the average for men, the wage differential shrank faster than in other industries..." 3/7/2004

Should developing countries allow free movements of capital across their borders? Brad DeLong wrestles with this one. Fifteen years ago "it was easy to be in favor of international capital mobility." Capital controls led to corruption, as people competed for the right to move capital by bribing the civil service. Moreover, free capital was expected to migrate to poor countries, boosting productivity and incomes. What actually happened was that capital migrated from the poor countries to rich countries, and developing countries "with open capital flows" turned out to be vulnerable to capital crises.

The fact that the flow of capital seemed more to go from poor to rich than from rich to poor, that capital flowed by and large to capital-abundant regions like the United States, was disturbing. International capital mobility was supposed to add to, not drain, the pool of funds financing development in peripheral countries." Protecting consumers from interstate shipments of wine Jim Leitzel at Vice Squad posts on state efforts to keep their consumers from buying wines in other states over the internet: "Other States Join Michigan Appeal On Interstate Alcohol Shipments". The post is motivated by Michigan's appeal of a federal court ruling overturning Michigan regulations forbidding direct alcohol shipments from out of state, but not in-state, wineries. Leitzel links to the ruling, a press release from the Wine and Spirits Wholesalers of America, and testimony by Nobel Prize winning economist Daniel McFadden (owner of a vineyard). The press release is worth reading for items like:

The crux of this case, however, are Michigan regulations that treat in-state and out-of-state wineries differently, and appear to suppress the competition faced by the in-state firms. As the federal court decision states:

[The distinction] can be gleaned from various Michigan Liquor Control Commission regulations, which are codified within the Michigan Administrative Code. R436.1057 states that "[a] person shall not deliver, ship, or transport into this state beer, wine, or spirits without a license authorizing such action. . . ." The only applicable license, an "outstate seller of wine license," may according to R436.1705(2)(d) be obtained by a "manufacturer which is located outside of this state, but in the United States, and which produces and bottles its own wine." However, under R436.1719(4) the holder of such a license may ship wine "only to a licensed wholesaler at the address of the licensed premises except upon written order of the commission." In answers to interrogatories, a representative of the Michigan Liquor Control Commission indicates that "[a]t present, there is no procedure whereby an out-of-state retailer or winery can obtain a license or approval to deliver wine directly to Michigan residents . . . " In contrast, the Michigan Liquor Control Commission indicates that the "ability to deliver wine to the consumer is available to winemakers licensed in Michigan, inasmuch as under the provisions of MCL 436.1113(9) these licensees are permitted to sell at retail the wines they manufacture. . . . A licensed Michigan winemaker may deliver their [sic] own products to customers without an SDM [specially designated merchant] license . . . . The plaintiffs contend that this differential treatment of in-state and out-of-state wineries violates the dormant Commerce Clause because it gives in-state wineries a competitive advantage over out-of-state wineries. In-state wineries can, for example, bypass the price mark-ups of a wholesaler and retailer, making in-state wines relatively cheaper to the consumer and allowing them to realize more profit per bottle. In addition, the cost to an out-of-state winery of the license that enables it to sell to a Michigan wholesaler is $300, while a comparable Michigan winery must pay only a $25 license fee to qualify to ship wine directly to Michigan customers. Finally, for customers who desire home delivery, Michigan wineries have a competitive advantage over out-of-state wineries that cannot ship directly to customers. In response, the state argues that the regulations to which an in-state winery is subject "more than offset, both in costs and burden, any nominal commercial advantage given by the ability to deliver directly to customers" and characterizes the burden on out-of-state wineries as "de minimis." " The legal issues turn on a an analysis of the interaction of two provisions in the Constitution. Prohibition was repealed by the 21st Amendment. One part of the amendment reads, "The transportation or importation into any State, Territory, or possession of the United States for delivery or use therein of intoxicating liquors, in violation of the laws thereof, is hereby prohibited." On the other hand, the Commerce Clause, giving Congress the authority to "regulate commerce with foreign nations, and among the several states, and with the Indian Tribes..." has long been considered to place a limit on State powers to regulate interstate commerce. Revised in the course of 3-7-04. 3/3/2004

Inside the Bush White House Paul Krugman reviews two books on the internal mechanics of the Bush White House, in the New York Review of Books. These books, American Dynasty by Kevin Phillips, and The Price of Loyalty by Ron Suskind,

The new books go deeper into the agonizing question of what is happening to our country. Ron Suskind—an investigative reporter with a knack for getting insiders to tell what they know —offers a detailed, deeply disturbing look at how the Bush administration makes policy. Kevin Phillips—a former Republican strategist who feels that his party has betrayed the principles he supported—investigates the history of the Bush clan, and argues that this family history provides the key to understanding George W.'s motives and even his technique of governing..." People respond to incentives The Congressional Budget Office (CBO) has just released a short 10 page report on the economic impacts of U.S. anti-dumping legislation. This legislation allows firms to petition the government for tariffs on foreign imports, based on a claim that the foreign goods were "dumped" in the U.S. at an inappropriately low price. If the firms are successful they get to share in the revenues from the tariffs. Kash, at Angry Bear has a wonderful (hearsay) story about the profit opportunities this creates for entrepreneurs. Kash's story reminds me of the "Vipers of Abruzzi." As Stephen Rhoads tells it, Abruzzi "...was plagued by vipers, and the city fathers determined to solve the problems by offering a reward for any viper killed. Alas, the supply of vipers increased. Townspeople had started breeding them in their basements." (Rhoads, The Economist's View of the world) Getting back to the economic impacts of the antidumping law, the report summary says:

In addition to the prospect of foreign retaliation against U.S. exports, the distributions mandated by CDSOA are detrimental to the overall economic welfare of the United States because (1) they encourage the filing of more antidumping and countervailing-duty cases, resulting in more duties that on balance harm the economy; (2) they subsidize the firms receiving them, preventing resources from flowing to higher-value activities in other firms and industries; and (3) they increase the private and public cost associated with the operation and implementation of the laws. They also discourage settlement of cases by U.S. firms, which has mixed effects on the economy..." Does increased international trade promote child labor? Eric Edmonds and Nina Pavcnik say no (or more accurately, that the evidence isn't there), in this National Bureau of Economic Research paper "International Trade and Child Labor: Cross-Country Evidence". According to the abstract:

We find that countries that trade more have less child labor. At the cross-country means, the data suggest an openness elasticity of child labor of -0.7. [so as their measure of openness to trade increases by 1%, their measure of child labor is decreasing by 0.7% - Ben] For low-income countries, the elasticity of child labor with respect to trade with high income countries is -0.9. However, these relationships appear to be largely attributable to the positive association between trade and income. When we control for the endogeneity of trade and for cross-country income differences, the openness elasticity of child labor at cross-country means is much smaller (-0.1) and statistically insignificant. We consistently find a negative but statistically insignificant association between openness and child labor conditional on cross-country income differences when we split the sample into different country groups, consider only trade between high and low income countries, or focus on exports of unskilled-labor intensive products from low income countries. Thus, the cross-country data do not substantiate assertions that trade per se plays a significant role in perpetuating the high levels of child labor that pervade low-income countries." 3/2/2004

Now you see it, now you don't! Robert Greenstein and Joel Friedman,of the Center for Budget and Policy Priorities,report on a "Budget Rule Change [that] Would Make the Cost of Extending the Tax Cuts Disappear"

The audacity of the Administration’s proposed change becomes apparent when the proposal is considered in the context of the budget gimmick used to facilitate passage of the 2001 and 2003 tax cuts. The Administration and the Congressional leadership wrote sunset dates into the 2001 and 2003 tax cuts for the purpose of making the cost of those tax cuts look smaller. This allowed more tax cuts to be packed into the legislation without breaching Congressional budget limitations. This gimmick worked because CBO was required under the rules to assume that the tax cuts would, in fact, expire and would thus have no cost in the years after they to sunset. The Administration’s proposed change to the baseline rules... would require CBO to reverse its earlier approach and assume now that there would be no cost associated with extending these tax cuts beyond their sunset dates..." Revised 3-3-04 3/1/2004

Laurence Kotlikoff Laurence Kotlikoff is worried. He thinks the medium term U.S. budget deficit is a cause of concern, and that U.S. unfunded political liabilities for Social Security and Medicare are unnerving. His The National Interest paper with Niall Ferguson, "Going Critical. American Power and the Consequences of Fiscal Overstretch" draws on another paper by Jagadeesh Gokhale and Kent Smetters, "Fiscal and Generational imbalances: new Budget Measures for New Budget Priorities." Their starting point is a question asked and answered by Gokhale and Smetters:

Countries often deal with fiscal crises through inflation.

But don't panic. To solve a problem you must first understand it. Kotlikoff and Burns take us on a guided tour of our generational imbalance, first introducing us to the baby boomers-- their long retirement years and "the protracted delay in their departure to the next world." Then there's the "fiscal child abuse" that will double the taxes paid by the next generation. There's also the "deficit delusion" of the under-reported national debt. And none of this, they say, will be solved by any of the popularly touted remedies: cutting taxes, technological progress, immigration, foreign investment, or the elimination of wasteful government spending. So how can the United States avoid this demographic/fiscal collision? Kotlikoff and Burns propose bold new policies, including meaningful reforms of Social Security, and Medicare. Their proposals are simple, straightforward, and geared to attract support from both political parties. But just in case politicians won't take the political risk to chart a new direction, Kotlikoff and Burns also offer a "life jacket"-- guidelines for individuals to protect their financial health and retirement."

Oliver Hardy of Laurel and Hardy fame died, but Lyle Lovett was born. Lyle’s birth was not much noticed at the time because 1957 was the year we produced the most babies ever born in America in a single year. We did it at the rate of one baby every seven seconds, closing the year with 4.3 million newborns, from a total population of only 172 million. You can get an idea of what a staggering feat that was by doing a modern comparison. In spite of having 100 million more Americans today, we produced fewer than 4 million newborns a year through the late 1990s..." Minor changes 3-2-04. How to run a country into the ground The dictator Kwame Nkrumah made a mess of Ghana's economy. Abiola describes the political policies, and links to a PBS site on the economic policies, by which he did this. The Beverly Hillbillies notwithstanding, its not always good to find oil on your land. Abiola tells what happened in Nigeria. Price discrimination Alex Tabarrok explains why "buy one, get one free" promotions can be more profitable for stores than half price sales. He also links to an online introduction to price discrimination by Hal Varian. |