Ben Muse |

|

|

Economics and Alaska To leave a comment click on the word "comment" at the end of each post. Click here for Atom feed Juneau webcams

Alaska/Yukon photos

Race for World Bank PresidentThe Fight for Free Trade

Economics blogs

Australian economics bloggingCanadian economics bloggingUK economics bloggingViennese economics bloggingSports economics blogsTax blogsOther blogs

Economic Columnists

Journals OnlinePolicy Essays and Papers

Archives

Where are visitors to this page? (Auto-update daily since 12-27-04) |

8/31/2003

Distribution of the U.S. Federal tax burden New Congressional Budget Office (CBO) study on how federal government tax burdens were distributed among income groups from 1997-2000, here: "Effective Federal Tax Rates, 1997 to 2000" There are lots of tables and charts here, and I may try to reproduce some when I figure how to copy figures with my old version of Acrobat reader. However, the key points:

"Those overall trends were not uniform across the income distribution. The effective tax rate borne by households in the lowest fifth, or quintile, of the distribution climbed by 0.6 percentage points—from 5.8 percent in 1997 to 6.4 percent in 2000... In contrast, the rate faced by households in the middle quintile fell by 0.7 percentage points—from 17.4 percent to 16.7 percent. The top quintile’s effective tax rate was a steady 28.0 percent in both 1997 and 2000. The biggest reduction in rates was found among households in the top 1 percent of the income distribution: the effective rate for those households fell by 1.7 percentage points to 33.2 percent in 2000. That drop in rates resulted from a reduction in the effective corporate income tax rate faced by those households. "The increase in the overall effective tax rate stemmed from a rise of 0.8 percentage points in the effective individual income tax rate that was offset by smaller declines in the effective rates on payroll and corporate income taxes... Two factors contributed to the uptick in individual income tax rates. First, real (inflation-adjusted) income growth pushed more house-holds into higher tax brackets, a phenomenon known as “real bracket creep.” Second, reported income at the upper end of the income distribution grew disproportionately quickly, making a larger share of income subject to the higher rates of the top tax brackets. "Effective individual income tax rates rose (became less negative) for households in the lowest income quintiles and rose for those in the highest quintiles. They were nearly constant for households in the fourth quintile and fell for those in the second and middle quintiles... "Effective rates for other taxes showed little change between 1997 and 2000, almost regardless of income level. Social insurance, or payroll, tax rates were roughly constant for all households except those in the highest quintile, for which the cap on Social Security taxes limits the growth of payroll tax liability (see Figure 5). The effective corporate income tax rate fell slightly in every year between 1997 and 2000; the largest percentage-point decline occurred among the highest income categories... Finally, the effective federal excise tax rate during that period shifted by no more than 0.1 percentage points for any income group and was constant across all four years for households with the highest income... "Average real pretax reported income increased by 11 per-cent between 1997 and 2000... However, all quintiles did not see the same percentage rise. For households in the lowest quintile, average income grew by 3 percent, compared with 17 percent for those in the highest quintile. That unequal growth was observed as well in the top percentiles of the income distribution: average income for the top 10 percent of households climbed 20 percent over the three years but jumped 34 percent for the 1 percent of households with the highest income... "Because of the rapid growth of reported income for that 1 percent of households—and despite the decline in their effective tax rate—the share of taxes paid by the wealthiest households increased from 22.7 percent of all federal revenues in 1997 to 25.6 percent in 2000... Other households in the top 10 percent of the income distribution experienced a small increase in their tax share. The larger share paid by the wealthiest households was balanced by decreases in the shares paid by house-holds in the middle three quintiles and the lower half of the highest quintile. The share of taxes that households in the lowest quintile accounted for did not change over the period." Jackson Hole Conference ends The Federal Reserve Bank of Kansas City's 27th Annual symposium on economic policy, in Jackson Hole Wyoming, is over. Martin Crutsinger of the Associated Press reports, here: "Federal Reserve economic conference ends"

" "Some critics have argued that such an approach to policy is too undisciplined -- judgmental, seemingly discretionary and difficult to explain," Greenspan told the Kansas City Fed's annual conference, a venue he used last year to defend his handling of the 1990s stock market bubble. "Some advocates of more structured monetary policy, including Fed Governor Ben Bernanke, have said the Fed should adopt policy prescriptions like inflation targets, which many central banks -- including the European Central Bank -- use to keep prices within set boundaries..." James Stock and Mark Watson apparently gave a paper on changes in business cycle fluctuations that attracted a lot of interest. Fox News reports, here: "Study Shows Fed Was Lucky Over Past Two Decades "

"In a paper that gives little credit to the power of monetary policy for calming business cycles, economists from the National Bureau of Economic Research (search) concluded that improvements in policy were not the main factor behind the smaller booms and busts of recent years. "The drop in economic volatility has more to do with an absence of major blows like the oil shocks of the 1970s than policy, NBER economists James Stock and Mark Watson argued." In another post, DeLong noted that administration officials were missing from the conference: "Jackson Hole Conference".

Brad DeLong explains just how much fun it was, here: "Summer Dawn Comes to the Big Teat Mountains" and here "Jackson Hole Conference":

...debating whether "monetary policy" is usefully modeled by a John Taylor-style interest rate rule. ...listening to Alan Greenspan reflect on the "...strange phenomenon in 1998 of the sudden emergence of and sharp rise in risk premia on fundamentally-riskless but temporarily illiquid securities..." ...hearing the second conference chair in a row say that they are going to recognize Jacob Frenkel because they want to "...see how short and succinct a comment can be..." ...watching Ken Rogoff apologize because he "... didn't get the culture. This morning when I got up I put on a tie. And I didn't realize that the Jackson Lake Lodge is like Harvard: When they say that a room is 'wired' what they mean is that it has electricity..." ...and nodding as Guillermo Ortiz [Mexican central banker - Ben] says that he has a key intellectual advantage: while everyone else's thin blood is struggling to carry enough oxygen to their brain at the Jackson Lake Lodge's 6800 feet above sea level, he is actually breathing thicker air than he is used to..." Sir William Petty's catamaran Kieran Healy has a short posting (based on his reading of Pepys' diary) on 17th Century proto-economist William Petty's experiments with catamarans, here "Funding Basic Research ". Healy links to sites with writings by and about Petty. While Healy's post is short, he does link to a longer Petty catamaran post (use his "double-bottomed boat" link). 8/30/2003

Neoclassical and behavioral economics The Economist "Economics focus" column this week highlights research examining the implications of cognitive psychology for economic analysis. Modern mainstream, or neo-classical, economics is based on assumptions about decision making that cognitive psychology finds wanting. Neo-classical economics assumes that people make decisions to maximize a satisfaction or utility that does not depend on their income or consumption levels relative to those of the people around them. It assumes that people make decisions without regard to sunk costs or to their current endowments of goods. It assumes that they don't psychologically compartmentalize their budgets or resources, devoting the different compartments to different purposes. Results from cognitive psychology are challenging many of these assumptions, and economics is faced with figuring out the implications. The Economist column is devoted to research on one of these issues - the endowment effect. In summary, the article finds that experience in market contexts is associated with a learning process. Persons with little experience with market transactions have a significant endowment effect, but this disappears as they acquire experience. The article is here: "To have and to hold". The following selection doesn't address the main result of the article, but it does indicate what's at stake:

"With barely 10% of students opting to trade, the endowment effect seemed established (you would expect 50% to have swapped, given the random allocation of gifts). Even after a short time with things of little value, ownership had overwhelmed the students' prior tastes. Dozens of other tests have produced similar results, and have produced a wave of criticism of neoclassical economics. "The criticism has been taken seriously, as it should be: if the endowment effect is real, people's economic decisions are fundamentally different from what economists have assumed. The implications of this are profound. To take one example, the Coase theorem, which argues that initial allocations of wealth do not matter as long as markets allow people to trade their stakes—the rationale for government auctions of everything from radio spectrum to mobile-telephone licences—would no longer be valid. To take another, although economists have shown that you need only a few sharp traders for prices in financial (and other) markets to become efficient, the volume of trade with an endowment effect will be below what it might be without one." I think cognitive psychology will enhance and enrich neo-classical economics, but that neo-classical economics will ultimately retain much of its essential character. I've thought this since I read a book called Choosing the Right Pond by Robert Franks of Cornell (many years ago). Franks accepted that status matters to people, an idea not built into the neo-classical assumptions. He pointed to evidence that people care less about their position vis-a-vis people they don't come in contact with, and more about their position with respect to others in the circles within which they move. He also recognized that people are different, that status matters much more for some than for others, In this, he saw, were opportunities for gains from trade. Neo-classical theory suggests that in competitive markets, people will be paid a wage equal to the value of their marginal product. Now people differ in their marginal productivity as well as in their taste for status. Everyone could work in a firm where everyone else had the same marginal products and was paid the same wage. But how much better off things would be if people with a taste for status worked in firms with people who were indifferent to it! This would make the people who really valued status happier without a proportionate reduction in the happiness of the others. Relatively high wage people, who valued status highly, might be willing to give up some part of their wages in order to enjoy the proximity of other persons who had lower wages (and thus status). People with lower wages might be willing to work in an organization with higher wage and status persons if they were given a somewhat higher wage than they would otherwise have had as compensation for their relatively lower status. Frank's conclusion was that the range of wages observed would not be as wide as a marginal productivity wage model would suggest. As I recall he then had some ingenious tests of the hypothesis and did not reject it. Rationing forgiveness under conditions of excess demand Donald Sensing retells the story of Monsignor Hugh O'Flaherty and Col. Herbert Kappler, here: "Loving one's enemies". P.S. (8-31-03): A follow-up post: "An Israeli responds". Resource allocation when prices are set below the market clearing level (in Brisbane) John Quiggin describes the allocation of seats on a city bus, here: "Age before beauty" Why is Bustamante's proposed constitutional amendment to control gasoline prices a bad idea? California gubernatorial candidate Cruz Bustamente has proposed an amendment to the California constitution to allow the state's public utilities commission to regulate gasoline prices. Natural resource economist Lynne Kiesling describes some of the problems with this proposal, in this blog posting: "Bustamante's Proposal to Regulate Gasoline as a Utility". Drugs for poor countries I posted Thursday on the agreement this week to alter trade rules to make it easier for poor countries to access pharmaceutical drugs, here: "Drug availability for poor countries" Peter Gallagher posted Friday on the implications of the agreement. Gallagher provides some short, readable background, placing the agreement in the context of international patent protection treaties. He concludes that, really, this shouldn't have been a big deal:

"The legal conflict in the TRIPS Agreement, too, is pretty small beer. You can probably think of a couple of sentences that could be added to the TRIPS Agreement to work around specific problems with a small number of patented drugs without undermining the global patent system. "So why the agony? The real problems appear to have been ideological NGO's who have been pressing exaggerated claims about the public health consequences of the patents and a legalistic approach by the officials and lawyers advising the drug companies that seemed to exaggerate the threat to the companies' global interests "Most of the negotiators at WTO in Geneva share the general incredulity that this basically simple issue was not solved a year ago. Let's hope it's now behind us." 8/29/2003

Bad news from London (about traffic) Iain Murray in Tech Central Station critiques London's new congestion charge system, here: "Down the Tube ". I learned about this from Arnold Kling: "Demand Too Elastic?". I posted earlier this year on the London scheme: (a) "Using a fee to control externalities"; (b) "London's Congestion Pricing Scheme"; (c) "Follow-up on London congestion pricing". Lynne Kiesling on the Administration's new New Source Review rules Here: "New Source Review".

"So the complaint about the NSR changes seems to be that the companies will be allowed to upgrade their equipment without being forced to decrease their emissions. OK, so ... how does this make us worse off than we have been in the situation in which they choose not to upgrade at all? They will still be held to the same Clean Air Act regulations..." Bustamante wants to regulate gasoline prices as if gasoline were a public utility Mark Kleiman posts on the story here: "BAD and Good Reasons For Not Wanting Bustamente as Governor". 8/28/2003

Costs in the Canadian health care system Arnold Kling posts on the costs of health care in the Canadian health care system, here: "Canadian Health Care". Non-price rationing:

The IMF has concerns about U.S. fiscal policy CNNMoney reports on an upcoming IMF report: "IMF slams U.S. over budget "

"The report "criticizes the U.S. government's excessively optimistic assumptions regarding the development of overall state spending and revenues and the lack of a medium-term concept to consolidate budgets and reform the social insurance system," the draft said..."

How much interest is there in outdoor sports and wilderness experiences? Weak demand for outdoor recreation experiences? Alicia Ault reports on the 22nd Outdoor Retailer Summer Market in the OpinionJournal, here: "A Wealth of 'Gear'--for What?".

"According to the Outdoor Industry Association's 2002 annual recreation survey, the number of newcomers to cycling, canoeing, climbing, hiking and snowshoeing was flat, continuing a trend that started in 1999. Backpacking declined. And the outdoors folks are trying to figure out how to crack the youth market, which would rather jump off a cliff than hump a pack through the woods." California's budget crisis Mark Kleiman reports on California's budget crisis (with an interesting looking link to an analysis by UCLA professor Dan Mitchell, "Family Time, Cliffs, and Train Wrecks: California’s Ongoing State Budget Crisis"), here: "PLEDGING BANKRUPTCY". Kleiman writes:

"If California does not raise taxes signficantly this year, it will go bankrupt, this year. There literally won't be money in the state treasury to pay current bills. "The pseudo-budget passed by the legislature and signed by the governor includes several assumptions contrary to fact. In particular, it assumes a 10% cut in the state payroll, but we're now two months in to the fiscal year and no one has been laid off or had his pay cut. Every passing month means that the cut, when and if it happens, will have to be that much bigger in order to get to the 10% target for the whole year. And for the part of the state workforce under union contracts, pay cuts will require negotiations: a process that hasn't started and for which success can't be assured..." Steel tariffs back on the table? The LA Times has a report that the administration is reevaluating the tariffs it imposed on steel imports in 2002. The article is here (free registration with the Times will be required): "Bush Team Is Said to Seek Lower Steel Tariffs". The article claims that internal administration opposition to the tariffs is coming from the economic team, headed by the Treasury and Commerce Secretaries, and that Bush's decision on what to do will be based on the job impact:

"The president's decision ultimately will depend on whether he accepts that analysis or one by steel producers that the tariffs have saved more than 10,000 jobs, including ones in key electoral states such as Ohio, West Virginia, Pennsylvania and Michigan, advocates both for and against the tariffs say." Drug availability for poor countries I posted last night on a story that the U.S. had agreed to trade law revisions that would make it easier for poor countries to access drugs for illnesses such as AIDs, malaria, etc. ("Doha Round drug agreement"). The Economist carries the story here today: "The right fix?". I learned about The Economist column from "Jane Galt". Do good looking teachers get better course evaluations? Hal Varian reports on research at the University of Texas in today's New York Times. Dan Hammermesh and Jeff Biddle examined discrimination based on appearance by testing the hypothesis that better looking teachers received better evaluations from their students. Rather than link you to the Times let me refer you to Virginia Postrel's blog (which has links to related resources as well: "Good Looks=Good Scores". From the Times:

"They asked six undergraduate students to rate the photographs of the professors on a 10-point scale and used the average measure as a beauty score. The student ratings on the beauty scale were highly correlated with one another, suggesting that they were measuring the same aspects of appearance. "According to the economists' statistical analysis, good-looking professors got significantly higher teaching scores. The average teaching evaluation was 4.2 on a 5-point scale. Those at the bottom end of the attractiveness scale received, on average, a teaching evaluation of about 3.5, while those on the top end received about 4.5..." 8/27/2003

Doha round drug agreement Today's papers are reporting a possible agreement on liberalizing trade rules to make it easier for poorer countries to get obtain inexpensive drugs. U.S. opposition, out of a concern that drug patents would be undermined, prevented an agreement on this agenda item in the Doha Round trade talks last December. Apparently the U.S. is backing off of its opposition. Elizabeth Becker reports in today's New York Times, here: "In Reversal, U.S. Nears Deal on Drugs for Poor Countries"

"The reversal by Washington — meant to improve the access of millions of people in those countries to expensive patented medicines for AIDS and other diseases — could enhance the Bush administration's international standing and prevent the collapse of global trade talks to be held in Mexico next month. "After weeks of intensive negotiations, the United States won assurances that countries would not take advantage of the arrangement to increase exports of generic drugs to nations that are not poor and do not have a medical emergency, diplomats involved in the discussions said..."

8/26/2003

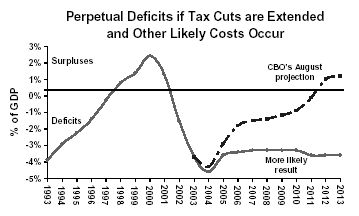

New, higher, budget deficit estimates The Congressional Budget Office issued new federal budget deficit projections today. Jonathan Weisman reports in the Washington Post, here: "2004 Deficit to Reach $480 Billion, Report Forecasts"

"But if President Bush succeeds in making his tax cuts permanent, the government will run substantial budget deficits as far as the eye can see, the forecast made clear. Add the White House's proposed $400 billion prescription drug benefit, and the deficit would total $324 billion in 2013..."

Enactment of the 2001, 2002, and 2003 tax cuts has filled the federal tax code with tax breaks that are scheduled to expire between 2004 and 2010. If Congress makes these tax cuts permanent — and there will be very strong pressure to do so — projected 10-year deficits will increase by $1.85 trillion (including the additional interest payments on the debt). In addition, while two percent of tax filers will be subject to the Alternative Minimum Tax in 2004, that figure is set to explode in subsequent years. If Congress amends the AMT so no more than two percent will be subject to it in years after 2004, the ten-year deficit will increase by another $760 billion. Program increases — primarily for the military, Iraq occupation and reconstruction, and a Medicare prescription drug benefit — are expected to swell the deficit by up to an additional $1.1 trillion over the ten-year period..."  8/25/2003

Why people on the left should be in favor of free trade Angry Bear, a liberal economist and blogger, explained today why liberals should be in favor of freer trade, here: "Tariffs and Trade". Later in the day he elaborated here: "More Free Trade". 8/24/2003

The minimum wage vs. the earned income tax credit (EITC) The minimum wage is a legal requirement that employers pay no less than a certain sum per hour. The EITC is an amount that is subtracted from a worker's income taxes (or paid to the worker if the credit exceeds the worker's tax liability). Which is better for low income workers? Max Zawicky reports on a debate conducted by two other bloggers (Nathan Newman and Mathew Yglesias) and makes his own contribution, here: "You Say Potato, I Say Tomato". How to write a sentence Geitner Simmons is starting a new series of occasional posts on writing. He writes for a living and he writes well (as his blog posts show). The first post deals with the problems caused when you try and stuff too many ideas into a single sentence, with example from political columnist David Broder: "Better Writing: Breaking up an unwieldy sentence". 8/23/2003

Larry Summers Tomorrow's New York Times Magazine has an article by James Traub on economist and Harvard President Larry Summers. Here's the link: "Harvard Radical". Summers held important positions in the World Bank and in the Clinton Treasury. Here's an extract from the article describing his public policy career:

"Summers's position as an international civil servant precluded him from working on Bill Clinton's presidential campaign, as many of his Dukakis friends were doing, but he was desperate to be in the game. Summers spoke constantly about economic issues to his contacts in the campaign and suggested other economists for explicit policy advice. When Clinton won, Summers joined the transition team, hoping for a big job. "But Summers still bore strong traces of the Harvard House of Pizza. As Gene Sperling, a member of Clinton's National Economic Council and Summers's closest contact in the White House, put it, ''Here was a guy with a big brain, and you want him on your team, but there was a sense that you needed to have a grown-up around.'' Summers was hoping to be named chairman of the Council of Economic Advisers, but when he lost out he accepted the post of under secretary of the treasury for international affairs, where he would be surrounded by grown-ups. Nevertheless, the big brain stood Summers in good stead. He quickly gained a reputation as a master explainer -- the man who could lay out the macroeconomic consequences of any given change in tax policy, who could figure out in his head what effect it would have on the gross domestic product 10 years down the road. "In 1995, Robert Rubin became treasury secretary, and Rubin came increasingly to rely on Summers not only for economics but also for policy advice. ''Larry had an almost academic sense of purpose,'' Rubin said, ''but not an academic naivete.'' Rubin says that Summers understood how to market highly abstract policy in a way that would resonate with ordinary people. It also turned out that Summers could be a fine tactician, and even something of a diplomat, much to the surprise of White House officials. Summers played a leading role in the controversial bailout of Mexico in 1995, as well as in handling the Asian financial crisis in 1997 and 1998. Most people who worked for Summers at the time have only good things to say about him now. Stuart E. Eizenstat, who served as a deputy when Summers took over from Rubin in 1999, says that he never encountered the Summers of legend and lore. ''He was a prince to work for,'' Eizenstat told me. ''He was considerate of my views, he included me on all major decisions, he did not make snap judgments, he fought through decisions, he gave me a wide swath of jurisdictions.'' Several noneconomists who worked either for or with Summers said that he never condescended to them and that they always felt he was arguing in order to get to the merits. Washington is, of course, a place with a uniquely high tolerance for brusque behavior. "It is a truism among Summers's friends and colleagues that he ''grew'' during his years in the Clinton administration. Summers concedes the point, but only after converting it into a sort of utility equation: ''Over time, I came to see that mutual interest was often a more important catalyst to agreement than compelling logic.'' What is striking, and a little bit touching, is how very self-conscious this process was. With the model of Rubin ever before him, Gene Sperling recalled: ''Larry started really consciously working on the kinder, gentler Larry Summers. We talked about it all the time for years and years. It was not unusual for Larry to call and say, 'You think I was too abrupt at this meeting?' And I'd say, 'Yeah.' We'd talk about what to do.'' And so Summers rounded off his rough edges. It is a source of genuine wonderment to people at Harvard that the Larry Summers they are seeing is the sanded-down one..." Getting paid for getting bumped Airline passengers weren't always compensated for getting bumped from flights. Herbert Inhaber tells how it came about, and talks about the role of economist Julian Simon in the process, here in this Tech Central Station column: "Julian's Genius". Simon argued for the introduction of the market mechanism, rather than administrative rationing, "...when he found out that stewardesses were putting elderly people off overbooked planes, on the assumption that they would complain less than younger ones." I learned about this from Pejmanesque. 8/22/2003

French heat wave deaths The European heat wave may have killed 10,000 in France. Chris Bertram at Crooked Timber points out that, although we tend to view a disaster like this mechanically - heat applied to a given population kills a certain number - the actual impacts of the heat were mediated through French social structures. He draws attention to the work of Eric Klinenberg on a Chicago heat wave in 1995, and to Klinenberg's book, Heat Wave: A Social Autopsy of Disaster in Chicago. Here's the link to Bertram's post:"France's heatwave" Bertram links to interviews with Klinenberg, and to the Amazon page for Klinenberg's book. Excerpts from one of the reviews on the Amazon page, by Rob Hardy, follow:

Alaska fiscal future Amanda Bohman reports that Kevin Ritchie of the Alaska Municipal League, and Landa Baily of the Alaska Department of Revenue, made presentations on the state's fiscal future to the Fairbanks North Star Borough Assembly Thursday. The report is in the Fairbanks News-Miner, here: "Assembly weighs in on sales tax debate" Ritchie and the League favor an income tax over a sales tax. Baily described the Governor's plans:

8/21/2003

Globalization and inequality The Economist has a nice little essay on the relationship between globalization and worldwide income inequality ("Catching Up. If You Consider People, Not Countries, Global Inequality is falling rapidly") - summarizing a talk by Stanley Fischer at this past winter's American Economic Association meetings . Fischer was a high official at the International Monetary Fund. The article is premium content on The Economist's web page, but Brad DeLong has provided an extract, along with the key graphic, here: "In Memory of Rudi Dorbusch". DeLong also provides a useful link to a copy of Fischer's original talk. Another review of The Literary Book of Economics Jeff Jacoby gives it a good review in today's Boston Globe, here: "The unbearable dullness of economic writing". He wonder why economics writing is so hard to read:

"Alice in Wonderland" IF LEWIS CARROLL were writing today, he would have the Mouse recite "the driest thing I know" not from an old history book, but from something by a contemporary economist. Something like -- oh, like Alan Greenspan's testimony before Congress last month: "Some of the residual war-related uncertainties have abated further and financial conditions have turned decidedly more accommodative, supported, in part, by the Federal Reserve's commitment to foster sustainable growth and to guard against a substantial further disinflation. Yields across maturities and risk classes have posted marked declines, which together with improved profits boosted stock prices and household wealth. If the past is any guide, these domestic financial developments, apart from the heavy dose of fiscal stimulus now in train, should bolster economic activity over coming quarters..."

"For Watts, Robert Frost's "The Road Not Taken" illustrates the idea of opportunity cost -- the options forgone every time a choice is made. Six epitaphs from Edgar Lee Masters's "Spoon River Anthology" help illuminate specialization and the division of labor -- key elements of industrial productivity. "A Modest Proposal," Jonathan Swift's satirical recommendation that Irish children be eaten, is a perfect -- and grisly -- example of cost-benefit analysis..." Implications of our current account deficit with China Kash, at the Angry Bear reports on some of the political implications of our large and growing current account (trade in goods and services) deficit with China, here: "The “China Problem” on the Economic Agenda". Why we vote the way we do Parapundit points to a new study, here: "Ballot Candidate Name Order Influences Voter Choices ". 8/20/2003

Kling, on foreign outsourcing Arnold Kling's July 14 Tech Central Station column, here: "Please, Outsource to My Daughter ".

--Alan Blinder By Alan Blinder's definition, longtime conservative activist Phyllis Schlafly is looney. And, as Glenn Reynolds pointed out in a column on outsourcing, she is not alone. The phenomenon of using the Internet to outsource white-collar work has created the latest fad in economic terrors -- fear that the United States is about to be run over by that economic juggernaut: India...." How are California's gubernatorial candidates planning to address the state's fiscal crisis CalPundit is keeping track:

More bankruptcies than divorces John Quiggin finds that, in the year ending March 2003, there were more bankruptcies than divorces in the U.S. He considers the implications, here: "Broke vs broken up". Pre-Cancun maneuvers Peter Gallagher's blog follows trade issues closely. He posts here on the recent pre-Cancun U.S.-European Union agreement on trade: "Trans-Atlantic trade deal ", and here on an alternative proposal forthcoming from India, China, and Brazil: "The storm builds ". He notes that poorer countries restrict farm trade among themselves:

Immortality and its discontents Geitner Simmons speculates about the drawbacks of living to 600, here: "Immortality". "The Man Without Qualities" on electrical shortages Robert Musil at The Man Without Qualities posts on a column by Vernon Smith and Lynne Kiesling in today's Wall Street Journal. Smith and Kiesling argued for the use of flexible prices to help address electrical system problems, here: "Musil posting". Musil is posting on the same column I posted on earlier today: "What to do about electricity shortages" Musil points out that Smith and Kiesling are arguing for prices as a way of controlling congestion on the electrical lines and that the proposal is similar to proposals to use pricing to control congestion on roads. He points out the political obstacle. He also links to other blogmentary on the Smith and Kiesling column. I've posted a couple of times this year on the use of fees for dealing with traffic congestion: (a) "Using a fee to control externalities"; (b) "London's Congestion Pricing Scheme"; (c) "Follow-up on London congestion pricing"; (d) "Dealing with congested roads" Don't get too optimistic about Cancun Freer trade in farm products is important to poor countries. It is a key part of the ongoing "Doha Round" of trade negotiations. But these negotiations are not going well. Jacob Levy is not optimistic about a breakthrough at the Cancun meeting of ministers this September. Find his thoughts here, in this New Republic column: "Unequal Protection". And it is good for us:

What to do about electricity shortages Whenever I see an essay attributed to either Vernon Smith or Lynne Kiesling I take notice. When I see something attributed to both of them I'm especially interested. They've authored an essay in today's Wall Street Journal on electrical power reform which is well worth reading. The Journal isn't available online without a subscription, but here's a link to a couple of paragraphs from it on Kiesling's blog: "Smith and Kiesling in the Wall Street Journal" Here are some extracts:

And then there's this:

Terror requires a military and a police response. But a response is required at another level as well. If we are going to protect ourselves, while protecting what is important about our way of life - including our liberties - we are going to have to innovate and change many of the ways we do things. We are going to have to create a society whose institutions and physical infrastructure can, so far as possible, absorb terrorist attacks with minimal damage. There is work here for city planners, architects, transportation planners, and so on. There is also, apparently, work here for economists. Smith and Kiesling are right on the money in pointing to the need for institutions that have the flexibility to survive with minimal damage when they are under attack. 8/19/2003

Why doesn't overseas outsourcing justify trade barriers? Brad DeLong explains, here: "Outsourcing Our Future?".

"When foreign countries acquire the capability to make stuff, there are two impacts on the American economy. First, we can no longer sell the stuff we make abroad for such high prices as we did before: our exporters face more competition as they try to sell abroad. Second, our consumers and domestic businesses can buy things made abroad more cheaply: producers of import-competing goods and services find that they face more competition and must lower their prices, but other businesses find that their costs fall, and households find that their incomes buy more good stuff. "Which effect dominates? Theoretically, either one can. The opening of the Suez Canal and the coming of large-scale cotton production to India and Egypt after the U.S. Civil War was surely not good for the gross economic product of America's cotton south, and contributed (along with the boll weevil, the neglect of education and other public services, and the corruption of the herrenvolk democracy that set up Jim Crow) to the south's economic retardation toward the end of the nineteenth century (how big a role Egyptian and Indian competition played in this is not something I am confident that I can judge). But in the post-World War II world, it seems clear that the U.S. has gained much more than it has lost from the economic development of its trading partners. The U.S. as a whole benefits enormously from the fact that Japan is a rich industrial economy rather than something like Indonesia. The producer and consumer surplus the U.S. gains from trade with rich western Europe far exceeds what it gains from trade with poor eastern Europe. The way to bet seems to be that examples like the growth of other producers to compete with the cotton south are the exception, and win-win benefits are the rule..." "Left-wing neoprimitivism" Geitner Simmons posts on "...left-wing neoprimitivism -- the school of thought that says all will be well if modern society discards the (supposed) comforts of contemporary economic life and radically ratchets down economic conditions to 19th century levels (if not 18th century ones)..." here: "The Electrification Conspiracy". The BBC reports on a potentially dangerous feature of Microsoft Word Here: "The hidden dangers of documents".

"This could be embarrassing for any home workers whose colleagues find out that they have been applying for jobs while working at home or being less than complimentary about their co-workers... "With the right tools this hidden data can easily be extracted. "Unix and Linux users can turn to tools such as Antiword and Catdoc to turn the document, including its formatting information, into a simple text file..."

"He gathered about 100,000 Word documents from sites on the web and every single one of them had hidden information... "The hidden text revealed the names of document authors, their relationship to each other and earlier versions of documents. "Occasionally it revealed very personal information such as social security numbers that are beloved of criminals who specialise in identity theft. "Also available was useful information about the internal network the document travelled through, which could be useful to anyone looking for a route into a network..." 8/18/2003

What do patents do? A few days ago I posted on the origin of patents, in 15th Century Northern Italy, as a device to encourage innovation, here: "The origin of patents". I also posted on the role of patents in the pharmaceutical industry, here: "The history of Mevacor". Brad DeLong links to a new study, drawing on information about inventions displayed in two 19th Century world fairs, which suggests that patents don't increase the overall level of innovation, but they do change the direction of innovation, here: "Petra Moser on Nineteenth-Century Innovation" 8/17/2003

Business and Politics Liz Ruskin has a great story on the nexus between business and government in today's Anchorage Daily News, here: "Financial wizard works magic for Stevens. RUBINI: Investing with property developer has turned the senator's financial fortunes around.". Ruskin profiles Anchorage real estate developer John Rubini ("...whom the Alaska Journal of Commerce has named one of the 25 most powerful Alaskans..."), focusing on his relationship with U.S. Senator Ted Stevens, and more generally on his interaction with the political process.

"Rubini's firm, like Pfeffer's [a competing developer - Ben], operates at the intersection of private enterprise and public policy, where local government turns to business to realize its goals. Both Pfeffer and Rubini have been accused of exploiting their connections with city politicians to help their businesses. "Developers often hear that allegation, and most of the time it's unfounded, Pfeffer said. "There's nothing wrong with a developer giving campaign contributions or holding fund-raisers for the city's elected officials, he said. It's part of being seen as a credible and involved citizen as well as a developer, he said. "I think what the deal is in our business, you are doing projects in our community, and that means you have to interface and communicate with everybody," Pfeffer said. "You've got to communicate with the highest authority that has an opinion on it," he said. "All the same, Pfeffer accused Rubini of crossing the line this spring, when Rubini appealed to an Anchorage Assembly member to reopen the bid process on the new health department building site after his original proposal was rejected. " "What he's doing is working the politics to change the ground rules," Pfeffer complained at the time. "Pfeffer's response is more tempered now. " "While I think highly of John and Leonard, sometimes in the heat of the deal you can find yourself going down a path that is slightly outside the rules, and if that happens, I'm going to call it, and I would expect them to do the same," he said. "I don't begrudge them talking to (political leaders) to see if they can get it changed, but I don't think it's in the ground rules." "Hyde said Rubini's suggestion -- to start over and have bidders propose construction on land the municipality already owns -- would have saved the city money. And, Hyde acknowledged, it would have given JL Properties another shot at the project." The looming Medicare crisis Medicare funding poses big budget problems that we are not now facing up to. This Congressional Budget Office study ("A 125-Year Picture of the Federal Government's Share of the Economy, 1950 to 2075") projects federal Medicare expenditures growing from something like 2.2% of GDP today to almost 5% in 2030, and to about 9.6% in 2075. The following figure, from the study, projects federal outlays as a percent of GDP:  Part of the problem is the aging population. Gina Kolata points to additional problems posed for the Medicare budget as new, and expensive treatments, become available - in story in today's New York Times: "New Therapies Pose Quandary for Medicare" (registration may be required, the link may fail after a couple of weeks).

"Dr. Tunis, of the Medicare services center, says he understood that the costs of new technologies can be staggering. But he adds that cost has traditionally not been a consideration in deciding what to cover. "If the technology was effective, we would find a way to pay for it," he said. "There is no dollar value per life per year at which Medicare would decline to pay." But costs are mounting..."

"Dr. Cooper says the solution is to restrict the operation to a few centers of excellence where experienced surgeons will assess patients and decide who should have the operation. "Dr. Tunis agreed but said there were limits to how much policing Medicare could do, or wanted to do. " "We don't have a direct way of enforcing compliance with coverage, particularly in patient selection criteria," he said. "It's sort of an honor system. But a lot of these patient characteristics are somewhat subjective or qualitative." "And that, says Dr. Garber, is almost guaranteed to lead to overuse. "There is pressure from patients, doctors and hospitals to cover expensive new procedures, even if their benefits are modest. And that is understandable, Dr. Garber said. "If you the patient are insulated against the cost consequences of your decision, why not get the latest and greatest?" But, he added, there is a price to be paid. "One solution would be to greatly increase Medicare's budget. But that would mean tax increases. Another would be for Medicare to consider cost-effectiveness, rather than just effectiveness. But, Dr. Tunis said, every time that has been proposed, the agency has had to back down." 8/16/2003

What causes the enormous U.S. trade deficit? Brad DeLong posts on the causes of the large U.S. current account deficits over the last 30 years. Part is due to domestic fiscal mismanagement, part is due to foreign fiscal mismanagement, part is statistical errors, but part is also due to foreigners who want to hold dollar assets. DeLong anatomizes foreign dollar demand nicely: " "Exorbitant Privilege," or, How Worrisome Is the U.S. Trade Deficit?". Government credit cards Intel Dump looks at Pentagon efforts to control use and misuse of government credit cards, here: "Using government plastic to buy... well... plastic". Should Alaska use gambling to raise revenue? Alaska is in a fiscal bind, and gambling revenues could be one of the tools we use to cut ourselves free. Sean Cockerham reports on the state of play in the debate this summer, here, in today's Anchorage Daily News : "House ready to roll on gambling". Pete Kott, Speaker of the Alaska House, expects the House will act on a gambling bill, but apparently isn't so sure about the Senate. The Governor's thoughts aren't known. Ongoing this summer:

8/15/2003

Summer is coming to an end

Jane Galt explains why the Exxon Valdez cleanup didn't stimulate the (national) economy. Actually, why the the post-blackout cleanup won't be good for the economy, here: "Stupidest thing yet heard about the blackout".

"This will stimulate the economy -- think of all the money people will make cleaning up after the blackout!" That was a talking head on some radio show I listened to for about three minutes before hurling the radio across the room in sheer horror at the a) rampant partisan silliness b) stunning technological ignorance c) egregious economic illiteracy "...I've heard versions of this same illogical trope from many people. Environmentalists arguing that expensive new environmental regulations create wealth because, gee, look at all the new jobs we got making catalytic converters!* Big government types arguing that pouring money down a rathole on their pet project isn't really a waste of money, because now we've increased GDP by however much we've spent on rathole operators and expensive rathole pouring machines designed by 100% American engineering talent. Hawks who argued that the war in Iraq was just the medicine to cure our ailing economy, because, well, look how well World War II turned out!"... This looks like an interesting book The The Literary Book of Economics, by Michael Watts, got a good review from William McGurn in Wednesday's Wall Street Journal. Watts has culled the world's literature for selections that illustrate economic ideas and combined them with his own commentary.

Watts is a professor of economics at Purdue and Director of the Center for Economic Education there. His home page is here: "Michael W. Watts". He had an article in the fall 2002 Journal of Economic Education (JEE, available online) on "How Economists Use Literature and Drama. While I'm in the JEE's website, let me also draw your attention to Bradley Hansen's "The Fable of the Allegory: The Wizard of Oz in Economics", where he argues that the Wizard of Oz was not a populist monetary allegory, Donna M. Kish-Goodling's "Using The Merchant of Venice in Teaching Monetary Economics", and Edward M. Scahill's "A Connecticut Yankee in Estonia", and James Hartley's "The Great Books and Economics" where

Good News from Africa I posted last month on research by Elsa Artadi and Xavier Sala-i-Martin into African growth (or lack of it), here: "African Economic Tragedy". The August 14th Economist reports on three African nations that are currently doing well (Mozambique, Rwanda and Uganda), here: "Lion cubs on a wire"

What happened to Jane Galt during the blackout? Nothing striking, but something special? "Back online". Alaska gets $1.91 back for every $1.00 in Federal taxes The Juneau Empire carries an Associated Press story this morning reporting that Alaska receives $1.91 in federal expenditures for every $1.00 that is collected here in federal taxes. New Mexico receives the most federal money per tax dollar, $2.37, while New Jersey receives the least, $0.62. The story reports on a study by the Tax Foundation:

"A large number of federal employees usually reflects large military bases, Moody said. That's a characteristic Alaska shares with New Mexico. "The abundant grants to Alaska's state and local governments are harder to explain, Moody noted, but Sen. Ted Stevens is likely one reason. The Republican senator is chairman of the Senate Appropriations Committee, a post he first gained in 1997." 8/14/2003

The origin of patents Patent protection is a key element in the ongoing debates over the high cost of prescription drugs. I came across the following paragraph on the origins of patents today, in The Lever of Riches by Joel Mokyr. Mokyr's book is a history of technological innovation. The paragraph is in a chapter on technological advance during the Western European Renaissance. He's talking about the impact of the emerging modern nation-states on innovation:

The history of Mevacor Gary Taxali tells the story of the Merck cholesterol drug Mevacor, here "Too Much of A Good Thing Can Be Bad. The Pros and Cons of Pharmaceutical patents". Taxali follows Mevacor through 31 years of development, 20 years under patent, and the years following patent expiration. The tradeoff at the center of the story:

There is no doubt that patents foster innovation, especially for pharmaceuticals. But it is harder to know whether their current structure has struck the right balance between their costs and benefits for society. With drug patents, as with cholesterol, too much of a good thing may be bad." Taxali's article is in the Boston Federal Reserve Bank magazine, Regional Review. Jane Galt on institutional accountability Jane Galt (at Asymmetrical Information) contrasts the BBC's response to its current scandal with the response of the New York Times, here: BBC Blowing It. Her argument: The BBC doesn't face market discipline. It is funded by taxes, it has captured its regulatory board, its charter renewal is a long way off, it can afford to stonewall. The Times, facing market discipline, had to clean house. I learned about this from Pejmanesque. P.S. (8-15-03): The Economist summarizes the details of the BBC reporting scandal, here: "The BBC on trial".

8/13/2003

Steve Antler points to Clinton's "phallopriatic" surplus Steve Antler asks if the Clinton era federal budget surplus was really a good thing, here: "Time for a little vacation..." 8/11/2003

Too many economists When I was young man I thought that that anyone who spent as much time thinking about money as an economist did would eventually and inevitably end up with lots of it. I was wrong. On the other hand, I haven't regretted my career choice. The August 7 Economist reports on job prospects in the U.S. and Britain, here:"Jobs for economists. Unemployment forecast"

"...But for Americans now gaining doctorates, prospects are bleak. In 2002, the number of job openings for economists tallied by the American Economic Association (AEA) fell by 10%, the second decline running. Graduate-student membership of the AEA, a measure of the future supply of economists, rose by 14% (see chart)..." Spam and the tragedy of the commons Jonathan Rauch applies common property analysis to the problem of spamming.

I'd never realized Seabiscuit was such a big deal in the 30's. Neither had Donald Sensing who saw the movie last week and recommends it, here: "Seabiscuit on NPT or NFL on ESPN?"

The problem with developed world agricultural subsidies Jacob Levy at The Volokh Conspiracy points to what looks like a good series of New York Times editorials and stories on this the damage these subsidies (in the U.S., the European Union, and Japan) do to developing country agriculture, here:"Bitter Harvest

8/10/2003

Money doesn't buy happiness? The "Economics Focus" column in the August 7 Economist reports on some of the implications of recent research on the relationship between income and self-reported happiness, here: "Chasing the Dream"

8/9/2003

Externalities associated with one more driver Stuart Buck draws attention to a new paper estimating the impact of an additional driver on the insurance costs of other drivers, here: "A Tax on Driving?"

Democracy vs. social choice theory In a large number of very plausible voting scenarios, the results of voting by a group of people depend on the ways in which their votes are aggregated. A group of people can be led to vote to do "A" and not "B", or to do "B" and not "A" depending on which rules of the game govern the decision process. The "rules of the game" are referred to as the "agenda." Different agendas produce different outcomes, even if the participants, and their preferences, remain unchanged. This is a disturbing result. What is the significance of the will of the people, expressed through voting, if that "will" is dependent on the rules used to aggregate the votes, and will change with a change in the agenda. Kieran Healy points to an upcoming paper that claims to resolve the dilemma, here:Kieran Healy's Weblog: Deliberative Democracy and Social Choice. This is something I have to look at before I approach my public administration students with the voting and agenda results this fall. 8/8/2003

Caligula was as bad as they say Cronaca reports on excavations at the Roman forum which confirm some of the bad things said about Caligula, here: "Caligula: Suetonius borne out by Forum excavations". 8/7/2003

Wednesday's Aurora over Juneau The Juneau Empire has a great shot of Wednesday morning's Aurora Borealis over Juneau. Night light 08/07/03 8/6/2003

Steven Landsburg asks, "Why do gays smoke so much?" Here, at Slate: "Why Do Gays Smoke So Much?". This is a nice piece of economic speculation. He looks for the difference in smoking rates, not in differences in preferences or culture - a sociological or antropological approach - but in differences in income and relative prices. George Akerlof, Economics Nobelist, disapproves of the Administration's deficits (among other things) The German magazine Der Spiegel has an English translation of an interview with 2001 economics Nobel prize winner George Akerlof on its website (Akerlof's wife, Janet Yellen, was chair of Clinton's Council of Economic Advisors). Link here "A form of looting"

SPIEGEL ONLINE: Of what kind? Akerlof: I don't know yet. But I think it's time to protest - as much as possible." 8/4/2003

Steven Levitt Steven Levitt recently won the John Bates Clark award, given every two years to the U.S. economist under 40 who has made the most outstanding contributions to economics. Stephen Dubner gives him an entertaining profile in the New York Times, here: "The Probability That a Real-Estate Agent Is Cheating You (and Other Riddles of Modern Life)". Levitt has a special interest in the economics of crime and corruption. He is most noted for a paper linking abortion rates and crime rates. Dubner's profile highlights several pieces of crime related research (for example, Levitt's algorithms for idenfying teachers who cheat on exams evaluting their students). The following examples gives some of the flavor (but read the whole thing before it disappears from the Times' web pages):

"While negotiating to buy old houses, he found that the seller's agent often encouraged him, albeit cagily, to underbid. This seemed odd: didn't the agent represent the seller's best interest? Then he thought more about the agent's role. Like many other ''experts'' (auto mechanics and stockbrokers come to mind), a real-estate agent is thought to know his field far better than a lay person. A homeowner is encouraged to trust the agent's information. So if the agent brings in a low offer and says it might just be the best the homeowner can expect, the homeowner tends to believe him. But the key, Levitt determined, lay in the fact that agents ''receive only a small share of the incremental profit when a house sells for a higher value.'' Like a stockbroker churning commissions or a bookie grabbing his vig, an agent was simply looking to make a deal, any deal. So he would push homeowners to sell too fast and too cheap. "Now if Levitt could only measure this effect. Once again, he found a clever mechanism. Using data from more than 50,000 home sales in Cook County, Ill., he compared the figures for homes owned by real-estate agents with those for homes for which they acted only as agents. The agents' homes stayed on the market about 10 days longer and sold for 2 percent more." 8/2/2003

How will we pay for Medicare? Upcoming demands on the Medicare program are by far the most serious fiscal challenge we face. Arnold Kling points to the importance of economic growth, fueled by technological advance and its application, in helping us meet the challenge in this Tech Central Station column:"The Great Race". Critique of Michael Moore's movies Kay S. Hymowitz gives a pretty thorough critique of Michael Moore's work in the City Journal, here: "Michael Moore, Humbug". A systematic evaluation of purported lies ( the "bold faced lies," the "lies of omission," the "artistic lies," the "slanted, insinuating lies," and the "lies of exaggeration") only takes up part of the article.

"Then there are what we might call artistic lies. Bowling for Columbine opens in a branch of the North Country Bank, with Moore supposedly receiving a free gun in exchange for opening an account. At the end of the scene, he asks a bank employee, “Do you think it’s a little dangerous handing out guns in a bank?” before he runs out with the gun in his hand to the beat of a punk rock tune. It is a dazzling opening, full of energy and Dr. Strangelove absurdity. The only problem: it was staged. Commentators have been on Moore’s case about this, some even campaigning to revoke his Oscar, awarded for a genre supposed to be nonfiction. Anthony Zoubeck, a self-described “former Moore fan” who writes for the Illinois State University paper, the Daily Vidette, contacted Helen Steinman, the customer-service representative seen greeting Moore in the bank. “You can’t just come in here and get a gun,” Steinman explained. Moore “was only supposed to be coming in and pretending to open up a CD. What the girl who opened up the account really told him was that there would be a background check and that he wouldn’t get the gun for six weeks...” " Bad Employment Picture The workforce unemployment rate fell to 6.2% in July, but only because a lot of people gave up looking for jobs and left the workforce. The number of jobs filled actually fell by 44,000. The recession ended in November, 2001, but the recovery has been slow. The EPI points out that

The source for this graph is: "Dip in jobless rate, yet hiring slump persists" 8/1/2003

Corporations would like to shift "legacy costs" to the government Daniel Gross, writing in Slate explores the sources of big business support for the pending Medicare benefit, here:Socialism, American-Style - Why American CEOs covet a massive European-style social-welfare state. By Daniel Gross. Gross also points to the possibility that the pension liabilities of many companies may also be shifted to the public.

The answer, again, is a form of big government: the Pension Benefit Guaranty Corp. This federally chartered independent corporation insures some 32,500 old-fashioned private defined-benefit pension plans covering 44 million workers. When companies file for Chapter 11, they can essentially terminate their pension plans and shift responsibility to the PBGC. The PBGC covers the costs of administering and shoring up pensions by selling insurance premiums to participants. But it has the makings of a massive obligation for taxpayers. In testimony last spring, PBGC Executive Director Steven Kandarian described how the restructuring in industries like steel, airlines, retailing, and textiles is taking a toll on his agency's balance sheet. From fiscal 2002 to fiscal 2003, the number of pensioners that the PBGC is directly responsible for will rise from 783,000 to 1 million, with the sum paid out increasing from $1.5 billion to $2.5 billion. The total underfunding in the kind of pensions covered by PBGC exceeds $300 billion. And with these pensions concentrated in what PBGC euphemistically calls "our most mature industries," it's likely the PBGC will require some form of public bailout." |